Ecopetrol President Ricardo Roa confirmed the company’s Permian Basin field in Texas could be among assets under evaluation for divestment, responding to government opposition to fracking technology. The field, acquired under 2020 contracts, requires operational agreement updates and strategic decisions on future extraction.

Ecopetrol and Frontera Energy marked World Clean Energy Day with the inauguration of the new Quifa Solar Farm, incorporating 18MWp in the first quarter of 2026 and advancing Colombia’s energy transition.

Geopark announced a transformational acquisition of Frontera Energy’s entire Colombian exploration and production portfolio for US$375M cash at closing plus US$25M contingent upon achieving development milestones.

Colombia’s Constitutional Court suspended President Gustavo Petro’s economic emergency decree, halting multiple tax measures that would have significantly impacted the petroleum and mining sectors.

Mónica de Greiff, former president of Ecopetrol’s Board of Directors, explained in an extensive Revista Semana interview the circumstances surrounding her October 2025 resignation after initially attempting to resign in May 2025.

The US Department of Treasury’s Office of Foreign Assets Control (OFAC) issued General License 46 on January 29, authorizing established US entities to engage in Venezuelan oil sector activities including “lifting, exportation, reexportation, sale, resale, supply, storage, marketing, purchase, delivery, or transportation of Venezuelan-origin oil, including the refining of such oil,” subject to strict conditions.

For reasons that should be obvious, this quarter’s big topic of discussion (already) is the fate of Venezuela and what it means for the global oil and gas sector – and Colombia’s industry in particular. A (virtual) panel discussion at Colombo-Canadian Chamber of Commerce (CCCC) shed much light on the topic with much heat (passion) as well.

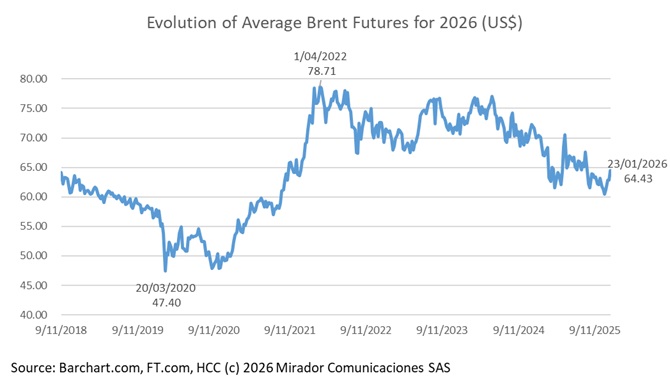

Fitch Ratings’ ‘neutral’ 2026 outlook for the global Oil & Gas sector reflects its assumption that the Brent oil price will average about USD63/barrel, down from USD69/barrel in 2025, with geopolitical risks supporting prices while large oversupply constrains them, Fitch says in a report published today (December 12, 2205).

Ecopetrol’s Board of Directors approved a 2026 Annual Investment Plan ranging from COP$22T to COP$27T, confronting a challenging environment marked by declining profits, low oil prices, and structural exploration restrictions.

According to Colombia’s Superintendente de Sociedades Billy Escobar, Canacol Energy’s cross-border reorganization process is advancing with a proposed US$67M financing package that could enable the Canadian gas producer to exit insolvency by late 2026. Publishing this because we get questions and some of you may not have seen this interview, but we cannot vouch for the information because this does not come from company press releases. Caveat Lector.