The first quarter is strange because some stragglers take the full 90 days they have to report 4Q results and then often are able to file 1Q results early. So we did not publish our price analysis last quarter and have two quarters´ worth of data for this quarter.

Members of the municipalities of Munchia, San Luis de Paleque and Trinidad have met with oil company representatives to discuss the poor quality of the department’s roads.

This week the peace process passed an important milestone after the Colombian government and Farc delegates reached an agreement over land reforms. The agreement, announced on Sunday, had by Monday become a top news item around the world.

When we started writing up company results, Canacol confused us with its production figures broken down between Tariff and Non-Tariff. We expect that shortly this distinction will come to an end.

The municipality of San Onofre has been through five mayors in the last year and a half, not to mention more than COL$ 5.5bn (US$ 2.9mn) in royalties from the Caño Limon pipeline which passes nearby.

A city council member of the Trinidad municipality will hold a meeting on May 31 to evaluate claims of environmental damage and noncompliance with social investments area communities have made against oil producers operating in the region.

Ecopetrol published the results of its 1% environmental compensation fund required by law, destined for the influence area of the Cupiagua oil field and other zones of the Casanare department.

The Farc and ELN are actively promoting blockades using the general population to disrupt production in a key economic sector, Colombia’s Vice Minister of defense Jorge Bedoya was quoted as saying.

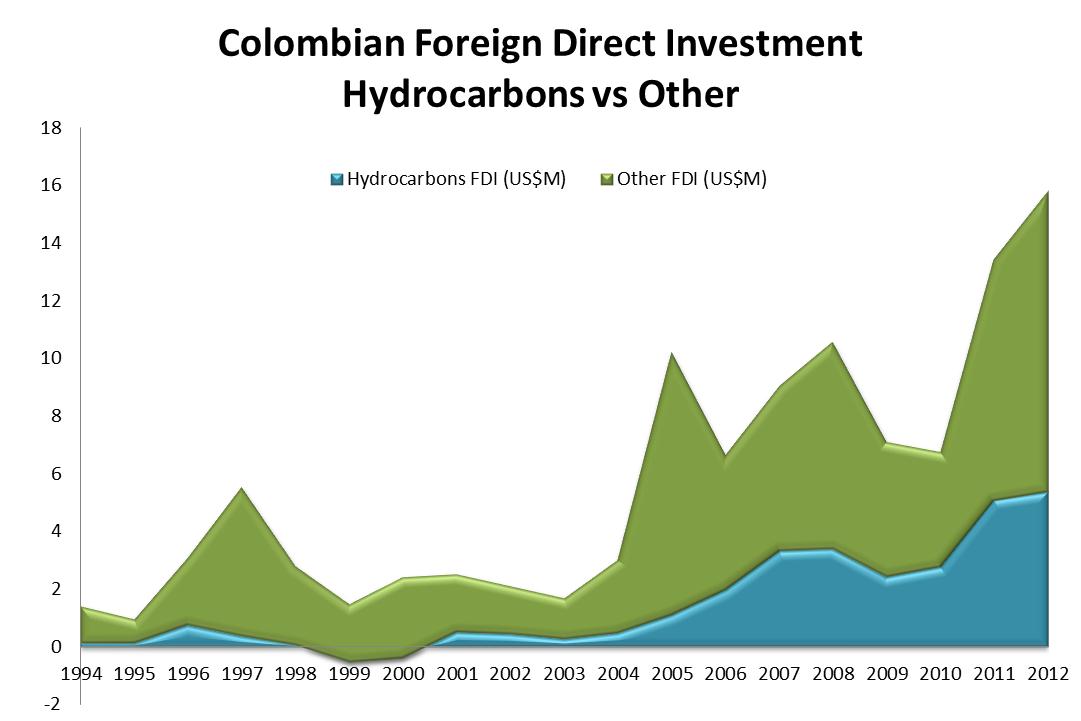

The oil sector accounted for nearly a third of all foreign direct investment (FDI) in Colombia in 2012, summing US$ 5.377bn of the US$ 15.823bn invested in the country during 2012, making it the 3rd largest destination of foreign funds in the region, according to an annual report on FDI published by the UN’s economic commission on Latin America (ECLAC).

Colombia’s mining vice minister Natalia Gutiérrez said that the government has decided to implement the Extractive Industries Transparency Initiative (EITI), joining Peru as the second nation in South America to do so.