Pacific Rubiales (TSX:PRE) had to wait more than two years for its environmental license for the CPE-6 block in the Meta Department, finally receiving the green light at the end of 2013. Now a few more details have emerged on the company’s obligations under the license agreement.

The Regional Autonomous Corporation of the Upper Magdalena (CAM) has fined seven transportation companies for environmental damage from oil spills, not having a contingency plan and non-compliance with preventative measures

The momentum towards unconventional oil extraction in Colombia is gaining, but the industry is still lacking an established supply chain to support the operations, as well as more clarity in regulatory matters said the director of the Colombian Petroleum Institute (ICP) Andrés Mantilla Zárate.

The arrival of Javier Betancourt as the new president of the National Hydrocarbons Agency (ANH) led to the resignation of three of the five leading posts in the entity and new appointments aligned with Betancourt’s mandate.

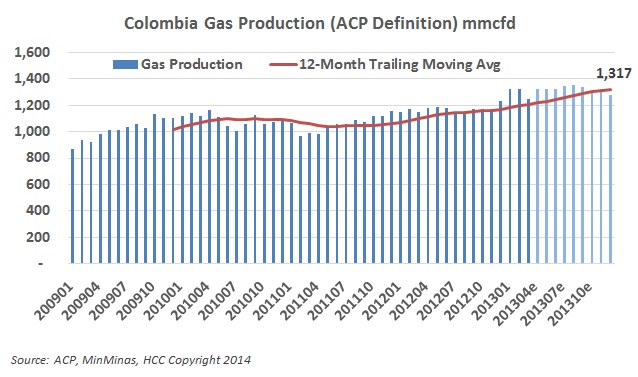

Naturgas, the Colombian association that represents the natural gas value chain from producers to distributors says the country has reserves for 14 to 15.7 years of demand.

Following elections last November, the USO has a new president, Edwin Castaño Monsalve, who replaced Rodolfo Vecinos as the head of the union’s national leadership. Castaño looks to expand the USO’s reach towards sub-contracted workers and like his predecessor, has his sights set on Pacific Rubiales (TXS:PRE).

While 2013 marked a continued transition to the new royalty system and a year of approving projects using these funds and adaptation, 2014 will be the year of execution and seeing the money at work, says the director of the National Planning Department (DNP) Tatyana Orozco de la Cruz.

A corruption scandal involving a pair of US former PetroTiger executives who paid an now ex-Ecopetrol (NYSE:EC) engineer more than US$300,000 to win a nearly US$50M contract has rattled Colombia’s oil industry, and the Ministry of Mines and Energy (MinMinas) issued a thorough release in which it establishes the engineer was working as a rogue and that the NOC is another victim.

Following up on a pilot program to subsidies the purchase of gas in cylinder the Ministry of Mines and Energy (MinMinas) says that the subsidies are ready to be claimed by for those who have qualified for the program in select municipalities.

The Ministry of Mines and Energy (MinMinas) issued a policy statement in which it has promised technical and procedural details on how it will regulate the exploration and production of unconventional resources over the next six months.