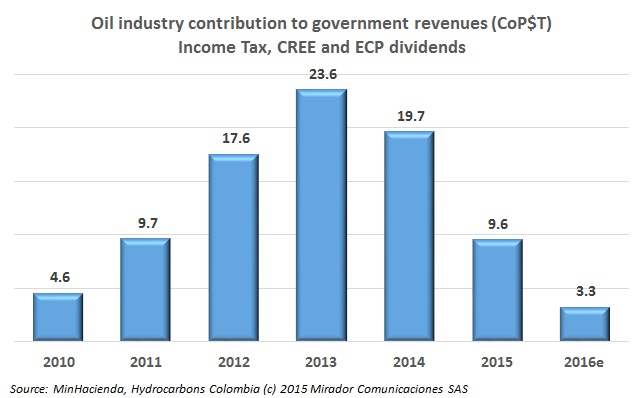

The Colombian Petroleum Association (ACP) used its recent congress to push for a tax reform that would address a heightened fiscal load on companies in order to improve investment, but President Juan Manuel Santos has ruled it out for 2015.

Those of us who grew up in Anglo-Saxon political systems with their long tradition of cabinet solidarity were no doubt shocked by Colombian Vice President German Vargas Lleras’ speech to the industry at the Colombian Petroleum Association’s 50th anniversary conference. In closing, he launched a virulent attack on his cabinet colleagues for not doing enough to maintain government revenues from the sector. The targets of his ire, MinMinas González and MinHacienda Cárdenas spoke later that morning.

The National Hydrocarbons Agency (ANH) invited an international energy expert to address the industry and highlighted a need to keep regulations flexible and operators efficient, and added that oil prices cannot continue to be blamed for all of the issues.

The mining industry suffers from many of the same problems as hydrocarbons, and a group formed to encourage dialogue between different sectors of society on the mining industry presented its first results after working together to reach a consensus. We ask if it makes sense to think about the same for oil and gas.

The hydrocarbons sector and authorities must adapt and consolidate in the current price scenario, which according to the president of the Colombian Petroleum Association (ACP) Francisco Lloreda is not going to change soon, and requires a new approach from that used in the past.

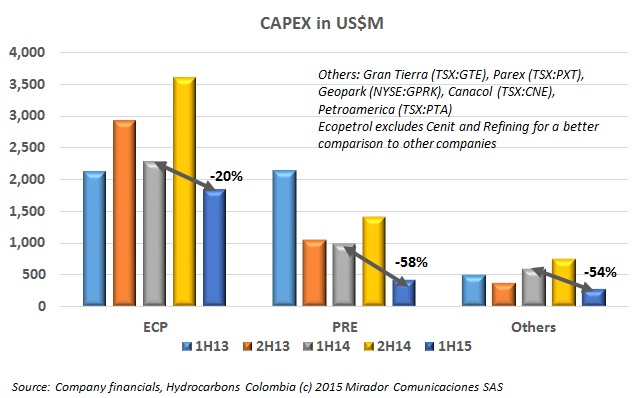

Yet another question from a subscriber on how Colombian E&P companies have reacted to the decline in oil prices. The answer for CAPEX is ‘fairly dramatically’ except perhaps for the NOC. And as the car-miles/gallon disclaimer says “Results may vary”.

As the Cartagena Refinery (Reficar) shows signs of operational life after a long delayed modernization project and appears ready to launch, the USO has started to voice its “reservations” on the project, its operators and alleged health consequences for workers.

The fact that biofuels do not need to be refined from crude, which first must be found and extracted, plus their environmental benefits make them a strategic bet that Colombia must consider, says the president of the biofuels association, (Fedebiocombustible) Jorge Bendeck.

The General Controller performed an audit of the Colombian Petroleum Institute (ICP), the research institute of Ecopetrol (NYSE:EC) and found 15 administrative findings, two fiscal and four “disciplinary” cases in its contracts worth a total of CoP$1.072B (US$370,000). Questions on an unsuccessful building of a butterfly sanctuary were also raised.

The legislative bill containing the constitutional reforms to facilitate the Havana agreements on peace passed their first debate in one session, but its main critics in the Centro Democrático party abstained, leading to confrontations with supporters of the bill.