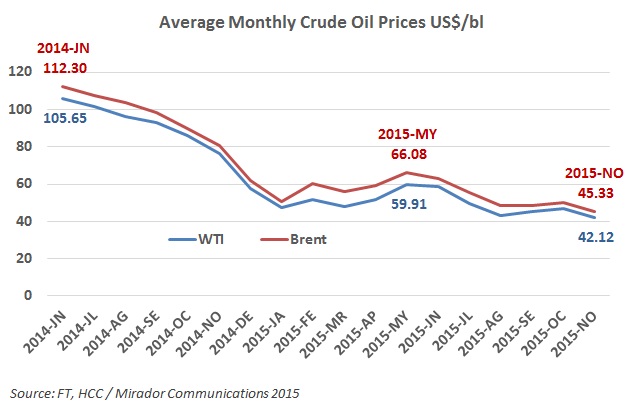

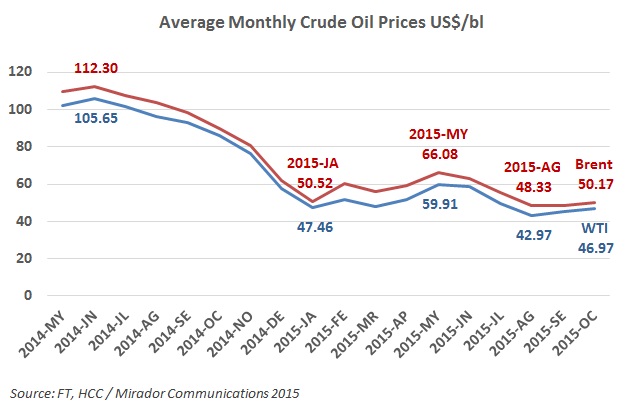

Well that could not last. After two straight months of increasing, prices fell again and we are now at a new low for past half-decade.

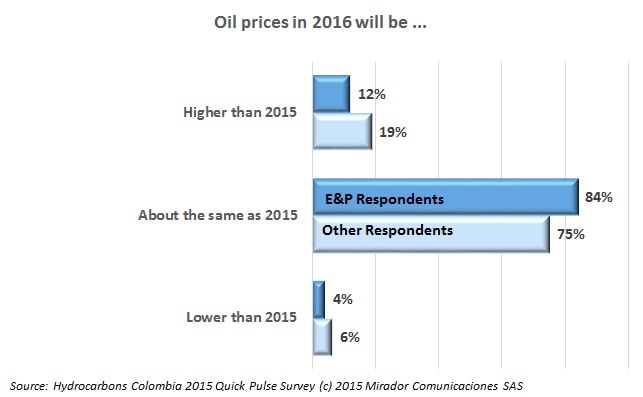

The fundamentals are not trending positively and so our readers are not planning for a brighter 2016.

This week “What we think” is really “What you think”. We broke our annual Quick Pulse Survey into two pieces, one addressing our traditional look ahead at 2016 and one addressing what we think is the main government policy issue at this time: incentives to get companies exploring again.

Editor’s Note: Jaime Checa is one of Colombia’s most respected geophysicists. When he speaks the industry listens. Here he reflects on the sorry state of onshore seismic in 2015, looking beyond the easy excuse of low oil prices.

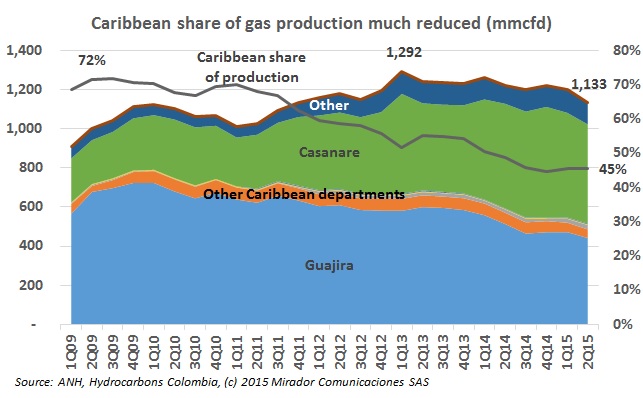

The arrival of El Niño has added a whole new dynamic to an ongoing debate raging along the Caribbean coast over the price of natural gas, as questions on the long term rates and short term supply alike fill the press.

In early 2013, Naturgas’ Eduardo Pizano and the ANDI’s then VP of Mining, Oil and Energy, Santiago Angel Urdinola staged a very public battle over whether Colombia had or did not have sufficient gas reserves to last into the next decade.

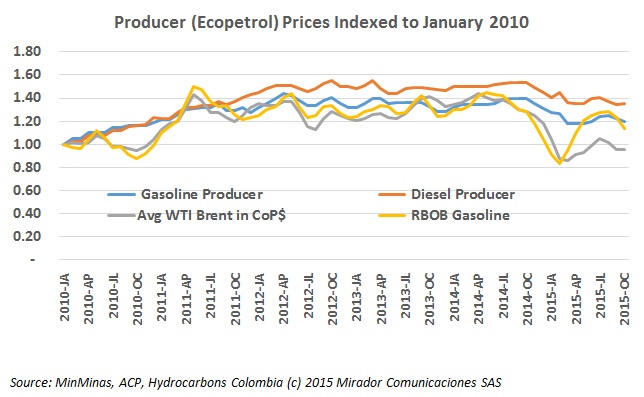

MinMinas announced gasoline and diesel prices this past week and as expected they went down. Also as expected, the truckers association and other groups thought they should have gone down further.

Positive momentum in September carried through to October and we have now had two straight months of increasing month-end crude oil prices. October ended on a positive note.

The National Council of Industry Associations and the 21 industry representatives which form it have signed off on an articulate and thorough document which addresses the concerns of these business sectors about the peace process in Havana, and more importantly, its impact on Colombia. With a diplomatic tone, it both justifies the fundamentals of the talks against its critics, but it is not a blank check for the government to push an agreement through on any terms.

This is the second and final part of an article we published last week with the same title (1). Peace certainly looks closer now than it has for decades. That does not diminish the challenge as this article from Intelligence Petrolera’s Carlos Goedder points out.