Forming a dialogue and advocating greater transparency among stake holders involved in the extraction of hydrocarbons is a needed but difficult task in the Colombian countryside.

We are learning from Hydrocarbons Mexico that when one company, especially the NOC, dominates completely the industry, the news is all about them.

I have to admit it’s getting better (Better) / A little better all the time (It can’t get no worse) – Lennon-McCartney

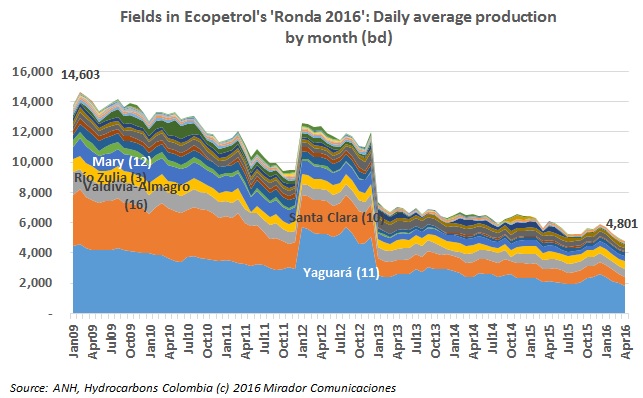

Last week Ecopetrol (NYSE:EC) announced its long-anticipated ‘Ronda 2016’, putting 100% of the NOC’s participation in 20 areas up for sale (bundled into 17 so-called opportunities).

Agree or disagree with the peace process, Thursday’s signing of a bilateral ceasefire is a watershed point in Colombian history.

The National Hydrocarbons Agency (ANH) published detailed crude oil production results for March and April and that allowed us to update our analysis of shut-in fields.

After a week in Mexico City and another week at the Global Petroleum Show in Calgary, Mexico’s ‘belle of the ball’ status is clear.

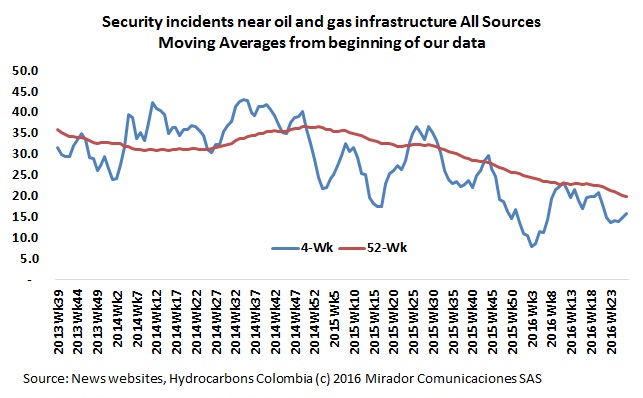

At the end of March of this year, the government announced the start of formal talks with the ELN guerrilla group. The talks are to move in parallel to the process with the Farc, which is in its final stages after nearly four years.

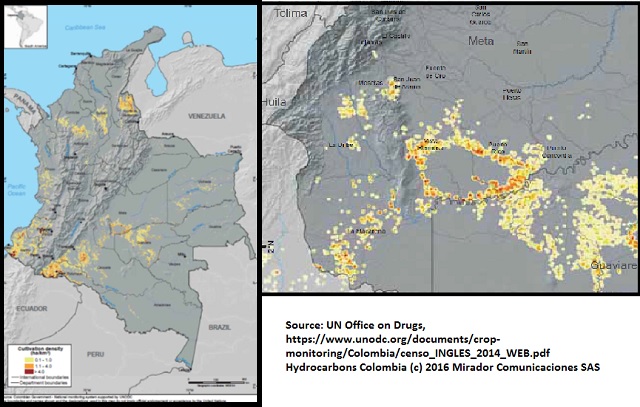

We found these maps that show areas of high intensity coca growing and many of these areas just ‘happen’ to coincide with zones of anti-oil fervor.

Editor’s Note: This was sent to us because we are on ACIPET’s press release distribution. When we started to read it, we thought it was tutorial material, a kind of Petroleum 101.