Our quarterly look at Ecopetrol (NYSE:EC) Line-of-Business (LoB) results usually focuses on comparatives. But the real story in 2Q16 was the increase in EBITDA from the E&P business.

We have given plenty of attention to the scope (and gaps) of the government’s “Territorial Strategy” being executed by the National Hydrocarbons Agency to mitigate community conflict.

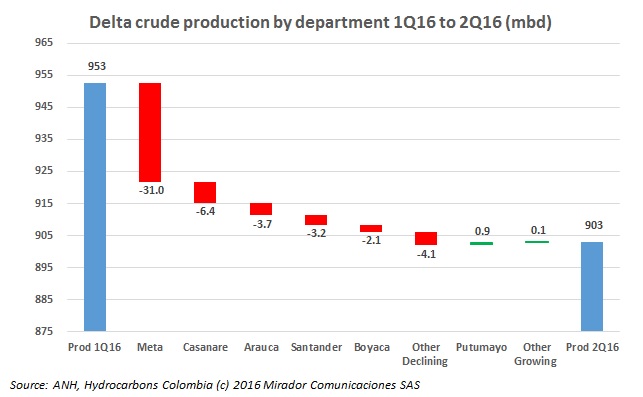

The crude oil production decline in 2Q16 – which continued in July – was a surprise for some observers (including us unfortunately). We know the reason is the lack of development drilling which is letting natural declines dominate production.

Everyone in the industry is concerned by the rise of violence against the oil industry over the past few months.

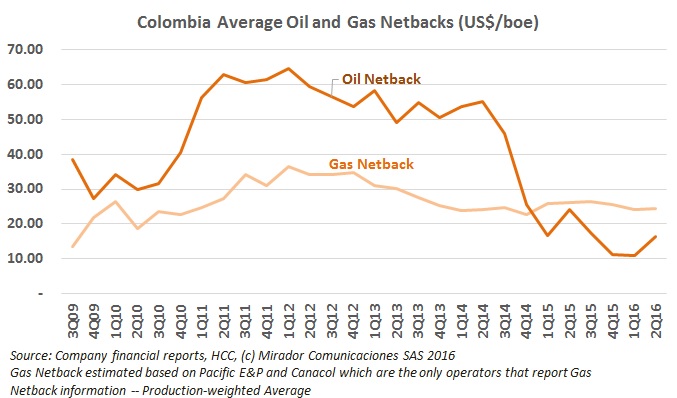

The graph shows that gas continued to be a better business than crude oil in 2Q16 despite rising oil prices which boosted oil netbacks.

The expression is “A rising tide lifts all boats” but that certainly applies to netbacks when prices go up. Brent was up 32.5% in 2Q16 and that helped all Colombian companies report better netbacks.

“Parex keeps moving forward” That was the phrase we used to describe Parex’s (TSX:PXT) 2Q16 results and somewhat to my surprise, Colombia President Lee DiStefano liked it.

A personal reflection the system for distributing royalties from non-renewable resources, to be read (preferably out loud) as a children’s fairy tale with appropriate exaggeration and drama.

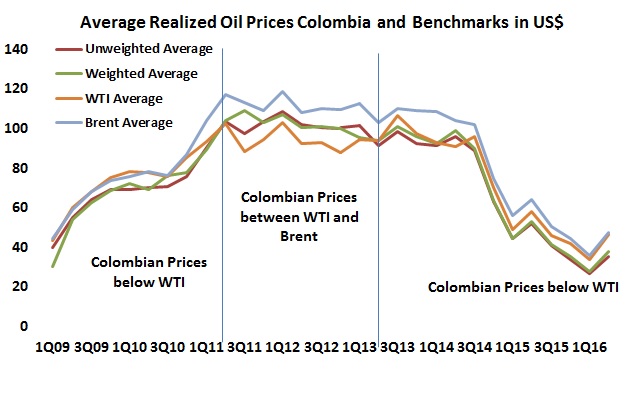

Now that all the companies that give us enough data to look at prices have published, we can see how average realized Colombian oil prices performed relative to the two global benchmarks. We also take a look at Vasconia.

This is a very bleak vision by the academic organization that is responsible for “disseminating knowledge on earth sciences and demystifying the production of oil as a hazardous activity”.