Luz Stella Murgas had senior leadership responsibilities in the ANH during the critical period when oil prices started to slide. As such she was involved in many of the initiatives designed to mitigate the impact of the disminution of exploratory activities, production and reserves.

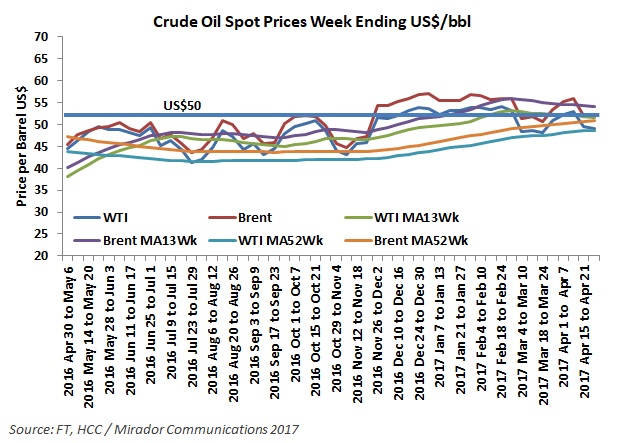

Last December we played ‘Casandra’ and warned not to get too excited by the boost that Brent (and to a less extent WTI) received from an OPEC agreement to reduce production.

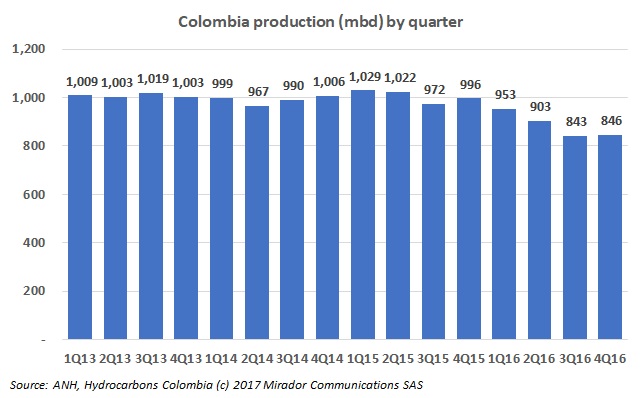

I do not know about you but the announcement of March production results depressed me. Even though we knew that March had to be a bad month, it depressed me because it added to a number of other indicators that suggested the Colombia industry was going through a bad period.

We know it is already 2Q17 but the ANH only just released detailed production results for 4Q16. This database allows us to go ‘beyond the topline’ and see detailed trends.

For weeks now, the Casanare press have been bubbling over Gran Tierra (TSX:GTE) and a block called El Portón.

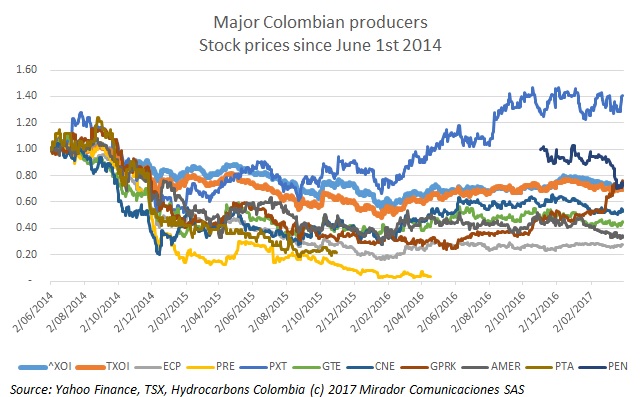

Unless you invested in Geopark (NYSE:GPRK) or Parex (TSX:PXT). But then the global indices were also down.

This week is Easter and so I have low expectations about how much this column will be read. Many loyal readers, at least those living in Latin America, may already be on vacation.

Cajamarca is a small city of about 19,000 people, southwest of Bogotá on one of the few ‘easily’-driven mountain passes crossing the Central Cordillera.

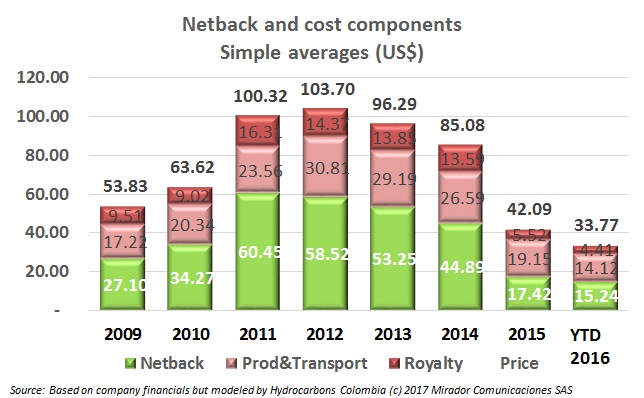

Costs were up in 4Q16 so despite higher prices, the average crude oil netback for publicly-listed reporting companies was down slightly in the quarter.