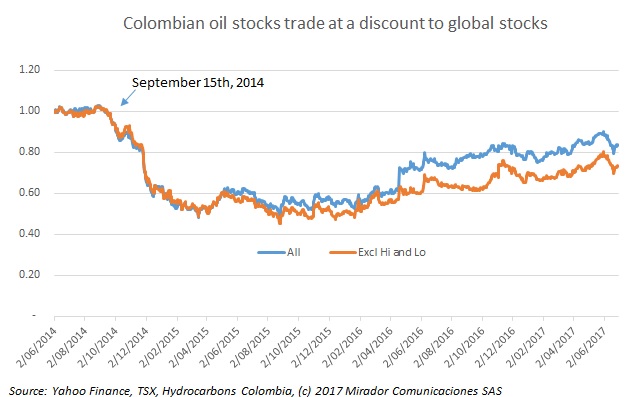

Since 2014, the share prices of Colombia-focused producers have underperformed their global peers, a phenomenon we call the ‘Colombia discount’. However lately, despite public policy challenges, the discount is slowly reducing.

Yesterday it was Pijao in Quindio and Arbelaez in Cundinamarca. Is it not time to ask if the government’s strategy should be revised?

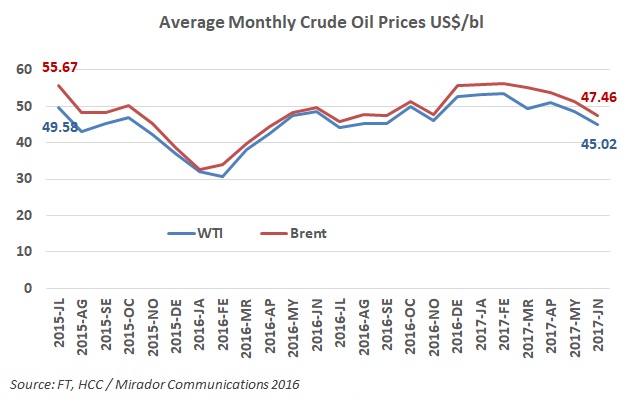

Continuing an unfortunate tradition, June was a bad month for oil prices. Maybe traders must close out their positions at the end of the quarter or end-of-half but the price slide started in June 2014 and since then this period of the year has not been a happy one.

Leon Teicher is Chairman of the Board of Continental Gold, a Canadian mining company operating in Antioquia who has contributed frequently to HCC on social and economic issues.

Geopark (NYSE:GPRK) is in the excellent position of operating LLA 34, one of the very few good-sized oil blocks that is still growing, still having new discoveries (along with partner Parex (TSX:PXT)).

While some in the oil industry –and many ‘hard’ miners for that matter – may be offended by our view that there are commonalities, it is becoming hard to deny that the evolving social and political situation for both has common roots and is creating common legal precedents.

We have compiled a list of 18 municipalities that either have had anti-oil/mining referenda, are definitely planning to do so or are known to be working towards a referendum.

Now Part 3 of our ongoing series written by Leopoldo Olavarría and the team at Norton Rose Fulbright on the Agreement 2, the National Hydrocarbons Agency’s (ANH) rewrite of the rules for block assignment and contracting.

Barry Larson is well known to the Colombian industry from his time at Parex (TSX:PXT) and now has one of the highest-profile jobs in the industry: trying to convince investors that Frontera Energy Corporation (TSX:FEC) (formerly Pacific Exploration and Production (TSX:PEN)) is not the same as Pacific Rubiales from whose ashes the new company arose.

Now Part 2 of our ongoing series written by Leopoldo Olavarría and the team at Norton Rose Fulbright on Agreement 2, the National Hydrocarbons Agency’s (ANH) rewrite of the rules for block assignment and contracting.