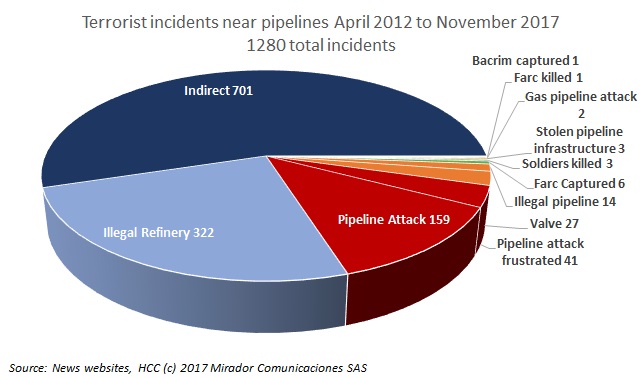

We decided to take a fresh look at our tracking of security incidents near pipelines to make the analysis easier and ensure we were being consistent in our classifications.

It is that time of year: vacations, family holidays, over-indulgence and long discussions about what might happen next year. As Managing Editor of Hydrocarbons Colombia, our predictions fall on my broad shoulders – and aging knees.

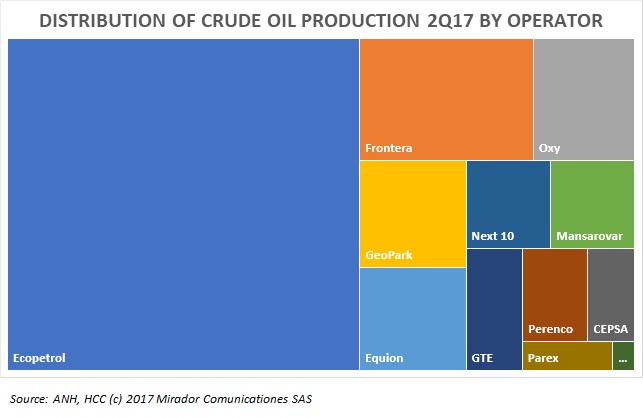

We have to admit to a certain fascination for how the world is distributed and how to represent its complexity. The Colombian crude oil sector is more concentrated than we (at least) might have expected but still has a so-called ‘long-tail’ of producers and operators.

The annual Expo Oil and Gas conference – now exclusively Campetrol’s – is a year-end ‘health check’ on how the industry is doing. Here are my impressions.

With everyone having reported 3Q17 financial results, we can do our quarterly look at prices and netbacks. The interesting result is that estimated oil netbacks have risen to the point where they are tied with gas netbacks.

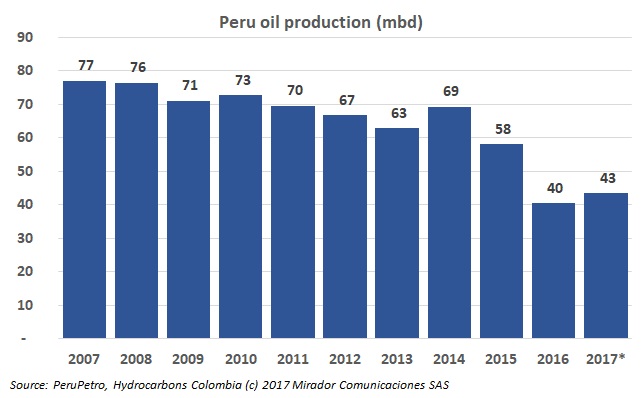

Last week we started our two-part look at the opportunities and challenges of developing oil and gas projects in Peru. In our concluding chapter, we look at the Amazon region, which has familiar conditions to those of the Colombian Amazon.

To accompany our report on the Peru market, we thought these charts on oil and gas, production and reserves would be useful.

Sustained oil and gas growth since the early 2000s and plenty of potential for further E&P, although to achieve it operators will have to go offshore or operate amongst the complexities of the Amazon.

Recently, the State Council issued a confusing ruling on the deductibility of royalty payments, especially those paid with respect to concession contracts for the extractive sector.

Last week, we published about a court ruling that (supposedly) would lead to taxing royalties (technically, removing a ‘deduction’ for royalties).