A few weeks ago, a poll appeared showing Gustavo Petro in first place for Colombia’s upcoming elections. Somewhat naturally, this raised eyebrows and raised concerns in the oil and gas industry.

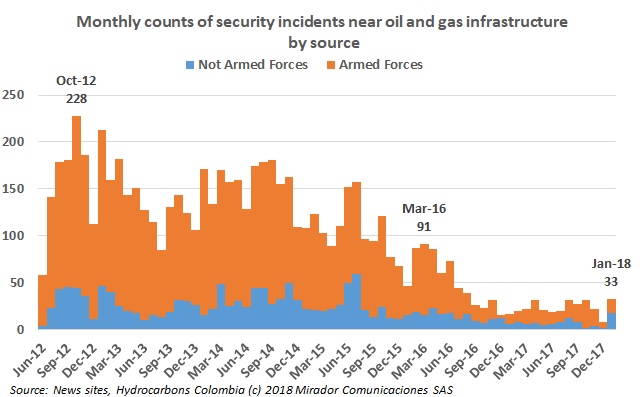

We did not publish our usual security summary for December 2017 even though it was the end of the quarter and the end of the year. By the time we started operations again after the year-end holiday period, the bilateral truce with the ELN was already over, ending literally with a bang. It made more sense to wait until the end of January.

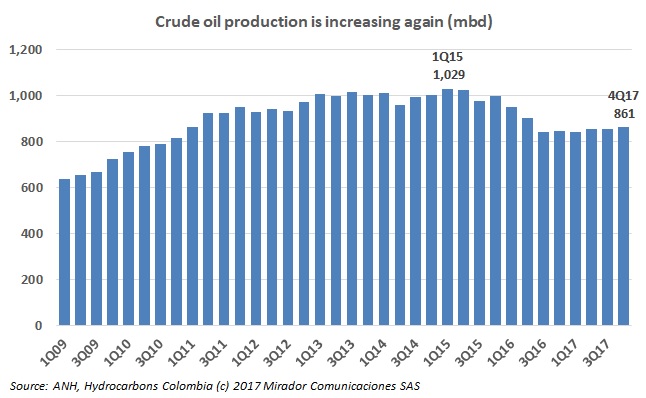

I have a deserved reputation for being a curmudgeon – always complaining – but looking at the statistical evidence, and listening to the industry, 2018 could shape up to be a good year. I am – shock! horror! – optimistic.

We have been borrowing the phrase from Casablanca to “Round up the usual suspects” in our analysis of quarter-over-quarter changes in crude production. We used it because the same block names kept appearing over and over. However, this quarter, things seem to be changing.

Following Article 8 of Law 1437 of 2011, the Ministry of Mines and Energy (MinMinas) published its Annual Action Plan for 2018. We saved you the trouble of ploughing through the 53 objectives and over 300 lines of Excel.

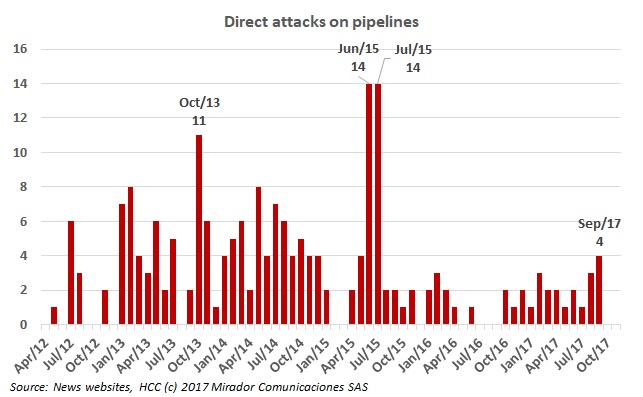

The Farc process is officially in the post-conflict phase and, despite stories of implementation failures on both sides, the UN Secretary General has given this a clean bill of health. But peace with the ELN is an entirely different story.

Some publicly traded E&P companies used to complain about a “Colombia discount” believing that investors undervalued their shares because of perceived defects in the Colombian environment (usually the ‘unholy Trinity’ of security, social conflict and environmental licensing).

Last month, we introduced our revision of our methodology for studying security-related incidents near pipelines. This time, we look deeper into the trends in attacks, the impact of security incidents on operations and at statistics by pipeline.

Marianna Boza leads the extractive sector practice for Brigard Urrutia, one of Colombia’s leading local law firms. She has an extensive experience in the sector, having spent much of her career with international law firms acting as external counsel to PDVSA before coming to Colombia in 2014.

A few weeks ago, we published a story about Barranquilla becoming a member of the World Energy Cities Partnership (WECP). I could not resist the temptation to make an ironic comment about being an ‘energy city’ without having produced a drop of oil.