With an Uribist government in power, I did not think I would have to update my “MinMinas Tenure Database” until August 7th 2024. But on last Thursday evening, I was proven wrong.

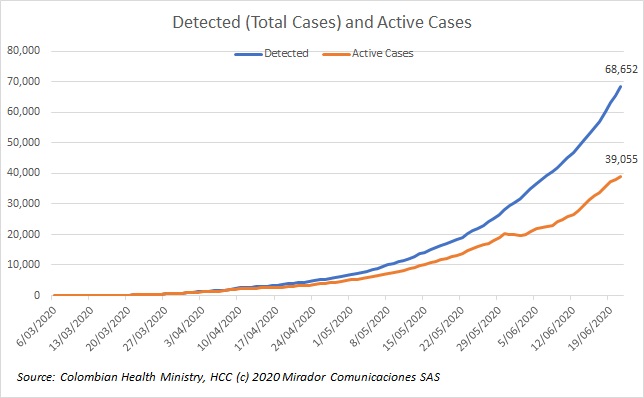

This past week marked three months of official lockdown for Covid-19, a lockdown which is now loosening. For those who might not be watching the numbers closely, here are the trends.

Between Covid-19, the resulting economic collapse and social unrest spreading throughout much of the globe, many of the principles that underlay the way the world worked in this century are under question. Recently we published two opinion pieces on the environment by a Long-Time Reader and now we have this contribution by the petroleum engineers’ association, ACIPET.

We said we would not be updating our index of shares prices of Colombia-focused companies because, with the departure of Amerisur, there were too few for an average to be meaningful. But that declaration was published on January 20th. Shortly thereafter the wheels came off the oil industry and the world more generally. And so curiosity got the better of us.

Last week Don Germán Montoya passed away at the age of 100, bringing to a close an illustrious career in Colombian business and public life. He had a profound impact on those of us who worked with him and he will be missed. The country will miss his counsel.

Our Long-Time Reader is back as life imitates art. It would be nice to imagine that his article in HCC inspired the Washington Post but that is highly unlikely. The newspaper is not even a subscriber! Instead, as he says in his opening paragraph, his commentary anticipated the Post article and the latter has inspired him to elaborate on his arguments.

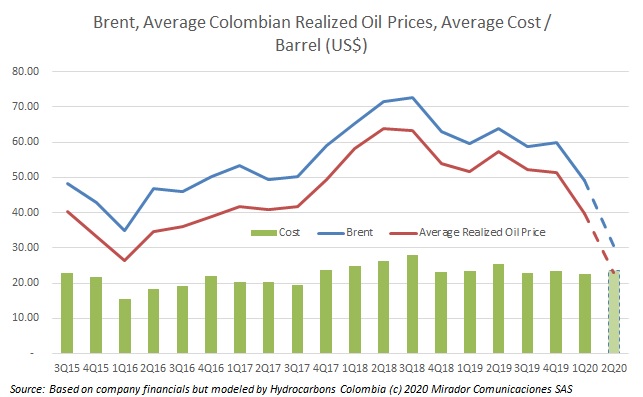

Actually, the time to shut-in fields (and at home) came at least a month ago but we thought we would look at trying to estimate what the impact might be on Colombian production.

A long time reader of Hydrocarbons Colombia sees a parallel between the worst case pandemic scenarios (scare tactics?) used by Governments to gain public support and those used by the environmental movement to force behavioral changes in energy usage. .

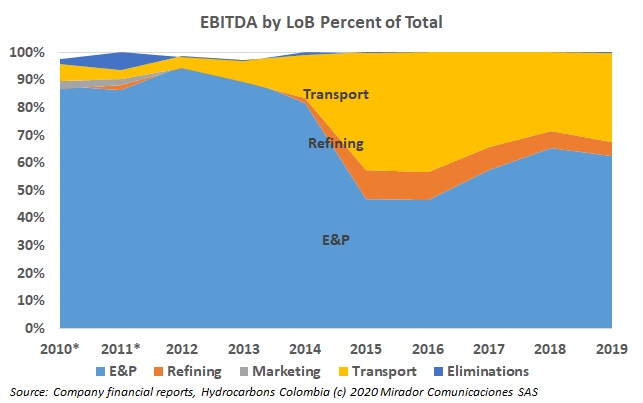

Last week we discussed pipeline tariffs using figures from Ecopetrol’s Line-of-Business (LoB) results. This week we present our full set of graphs for all of the LoBs.

This week the Colombian Petroleum Association (ACP) raised the issue of oil transport costs and in particular, pipeline tariffs. Given the government’s stake in the Cenit, which owns virtually all of the pipelines, the request for lower tariffs will likely be ignored. But Cenit’s victory may be pyrrhic this time.