Recently, I came across several articles, reports and webinars dealing with the special challenges of women in the oil and gas industry. Then I interviewed Marianna Boza, O&G and Mining Head at of Brigard Urrutia and one of the driving forces behind the Colombian chapter of Women in Oil and Gas, an initiative to bring greater gender equity to the sector.

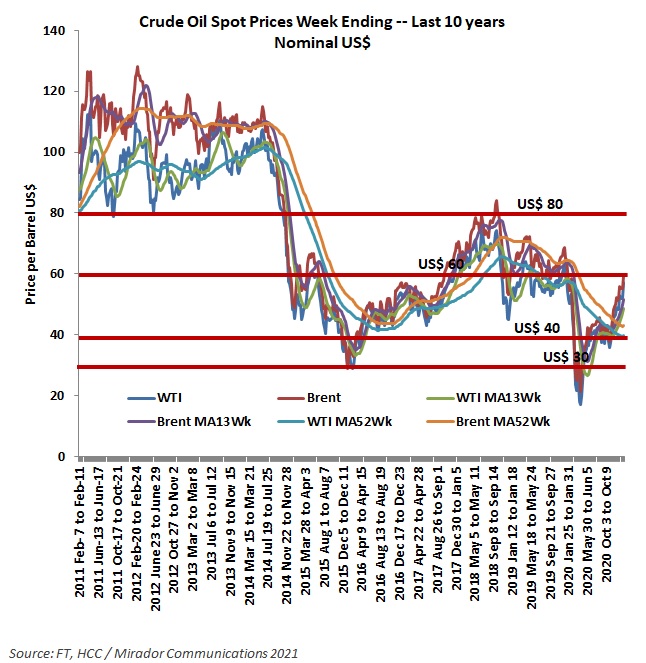

Last Friday Brent nearly closed at US$60 and in honor of that auspicious event, we decided to update our short- and long-term graphs.

The most surprising news of the past week was Ecopetrol’s decision to make a bid for 51.4% of the country’s long-haul electricity transmission provider, ISA. This could be a financial trick by Hacienda to turn 8% of its Ecopetrol stock into cash, a way to assure a floor price for ISA or it could be, as ECP said in its press release, a major step along its way to becoming a diversified energy company.

This past week Colombia passed a number of unfortunate Covid-19 milestones so we thought we should update our graphs. The country passed the 2 million detected cases mark on Saturday and earlier in the week, passed 50,000 deaths attributed to the pandemic.

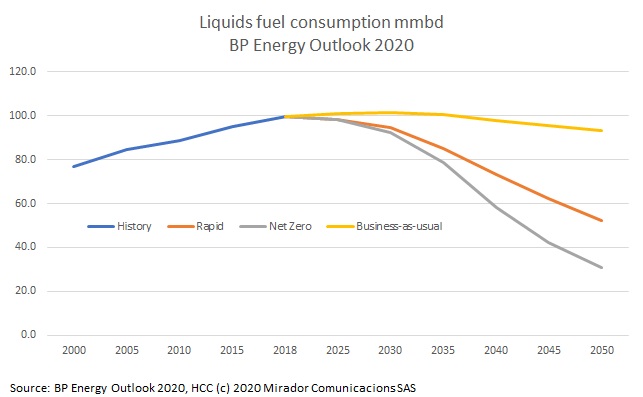

OK maybe the title is a little dramatic but I do not think that 2021 is any clearer – anymore free from fear about what might happen – than was 2020. And yet, decisions still have to be made, short-, medium- and long-term decisions, on the best information available.

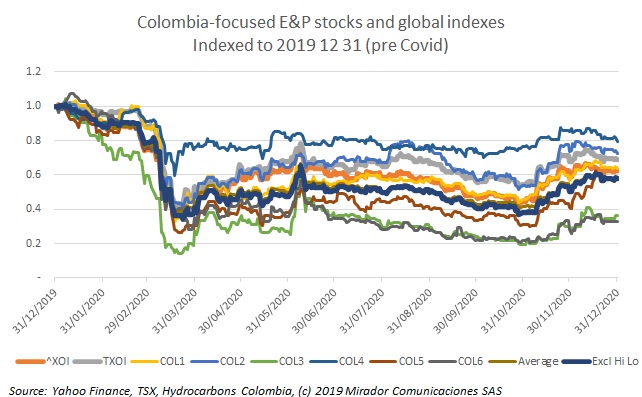

We said we would not be doing the Colombian Share Price Index analysis again because there were too few publicly-traded, Colombia-focused companies remaining to be meaningful. But Covid-19 changes everything and we could not resist a peek at what the topsy-turvy world of 2020 had done to our index.

To say the very least, this year did not develop as expected. Some aspects will pass, as a famous Doonesbury cartoon about the 1970s reminded us, and sometime this year or next we will feel more ‘normal’. Others are here to stay. Not all the members of either category are still clear.

But it helps to have worked on costs as well. A higher Brent price in third quarter made for better netbacks and netback margin this time.

When we started Hydrocarbons Colombia, we wrote a lot about roads. Roads were one of the main flashpoints between the industry and communities as heavy tanker-trucks and drill rigs tore up poorly maintained so-called ‘highways’ and too-frequent accidents created environmental and human suffering. Thankfully, that conflict seems to be largely behind us. Now Ismael Arenas, former head of Ecopetrol and current chairman of the Colombian Association of Engineers (ACIEM) reminds us that roads are still an issue needing coordinated action.

We have just finished the Third Oil and Gas Summit (III Cumbre de Petroleo y Gas) and as always it was packed with interesting sessions. While the ANH’s extended workshop on Friday will have the most impact in the short- and medium-term, my candidate for the most important long-term discussion was Thursday’s “Role of the hydrocarbons sector in the framework of the global recovery” (El rol del sector de hidrocarburos en el marco de la recuperación mundial), mostly because it had very little to do with the title.