Last week was the big show – the biggest oil and gas conference of the year – the IV Oil and Gas Summit, once again held virtually (apart from a presidential pre-candidates’ debate). The mood was generally positive but the elephant in the room, that almost no one talked about, hung over most of what was said.

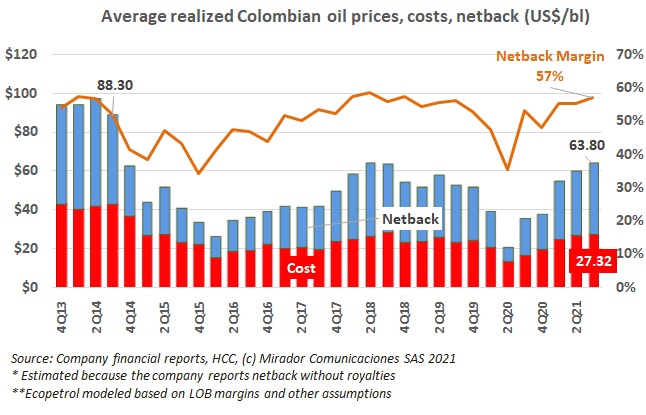

Average oil netback for the Colombian industry rose for the third consecutive quarter, thanks mostly prices rising for six consecutive quarters, but also improved margins.

Lunch was the Saturday-before-last, the day before COP26 began in Glasgow and just as the G20 were trying – and failing – to reach their own consensus on climate change. The university professor sitting next to me said “It’s not up to us anyway, is it? Only large companies and governments can do anything.” And the debate began…

Before the peace agreement with the Farc we kept statistics on security incidents that occurred near oil infrastructure. We stopped collecting the statistics when incidents fell off dramatically (or the press stopped reporting them). But now things are getting complicated in Catatumbo especially and a reader asked if we had any uptime statistics on the Coveñas /Caño Limón (CCL) pipeline which passes through some of the ‘hot spots’.

Suddenly everyone is talking about hydrogen, grey, blue, green and presumably all shades in between. Its appeal is an energy density (by weight) three times that of natural gas, three-and-one-half times that of crude oil. That makes it a prime candidate for transportation, one of the hardest sectors for energy transition.

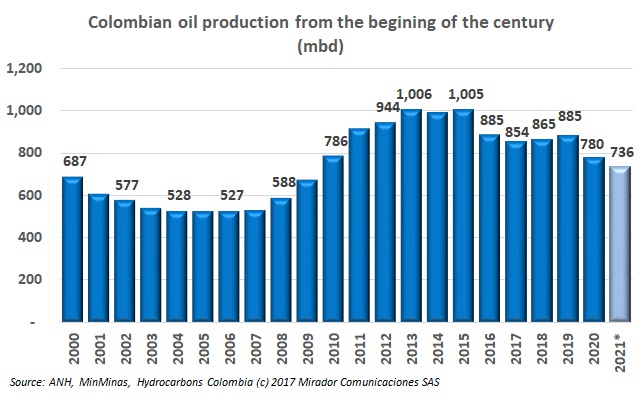

We do a periodic analysis piece whose working (and often final) title is “Winners and Losers”. It starts from the obvious that movement in Colombia’s total production is the net result of the movement of the production of literally hundreds of fields up (winners) or down (losers). Given what has happened since we last analyzed field-level results, one could legitimately wonder if there were any winners to write about.

A few weeks ago, I watched the results presentation for this year’s “Petroleum Barometer”. The plague-year’s impact on oil and gas producing communities seemed to have improved the industry’s standing with them.

Are we not supposed to be building back greener? And so, demand should be falling and taking prices with it? Instead, oil prices (and gas prices) are reaching heights not seen for many years. What’s next? Back to US$100? And what would happen to production?

Last week, Colombian engineers’ association, ACIEM, held its annual Enercol conference, this year, virtually. Former Ecopetrol President, Ismael Arenas leads ACIEM and his keynote had important messages for policy makers. Here is an extract from his remarks, focused on the oil and gas sector and related topics.

It has been four months since we last updated our Covid-19 tracking charts, time enough for Colombia’s Third Wave to come and go. The country is now at its lowest infection level since the early days of the pandemic but other countries are riding the delta variant to a new fourth, peak.