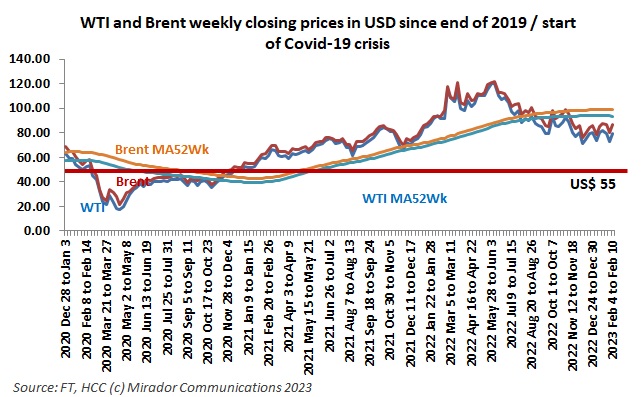

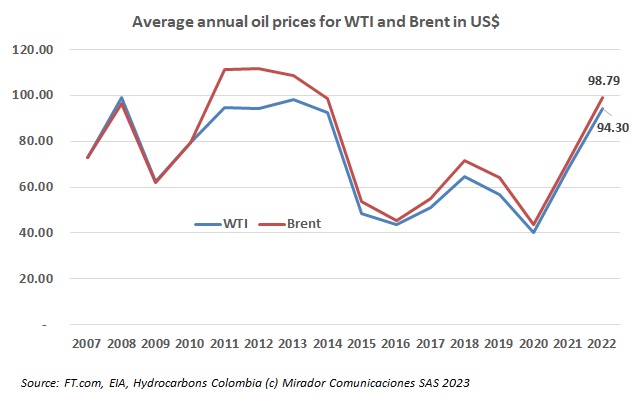

Despite the legitimate concerns about exploration and reserves, oil prices drive performance in the immediate term, both for companies and the national budget. The ups and downs of trader sentiment about global supply pushes prices back and forth.

During the FARC peace process, we wrote weekly updates. If I had been doing that for the current ELN process, this month I would have written literally thousands of words “full of sound and fury / signifying nothing”.

We do not get into financial analysis of individual companies nor are we your source for stock market advice. But we do keep track of how Colombia-focused stocks as a group are doing relative to global indexes because we believe this reflects government policy not individual performance. And we watch what is happening with Ecopetrol (NYSE:ECP) because, although individual performance plays a role, much movement reflects how its principal owner, the Colombian government, views the industry.

This week I should have published an Analyst’s Desk i.e. quantitative article but Minister Vélez keeps the issue of gas reserves and new contracts on the front burner of Colombian politics and I could not resist commenting. By the time the next What We Think slot comes up, who knows what she will have said or what government policy might be?

Colombia’s President Gustavo Petro says he admires his Mexican peer, Andrés Manuel López Obrador, better known as AMLO. We hope Petro chooses what he learns wisely and not tempted to apply AMLO’s strategy for Pemex to Ecopetrol.

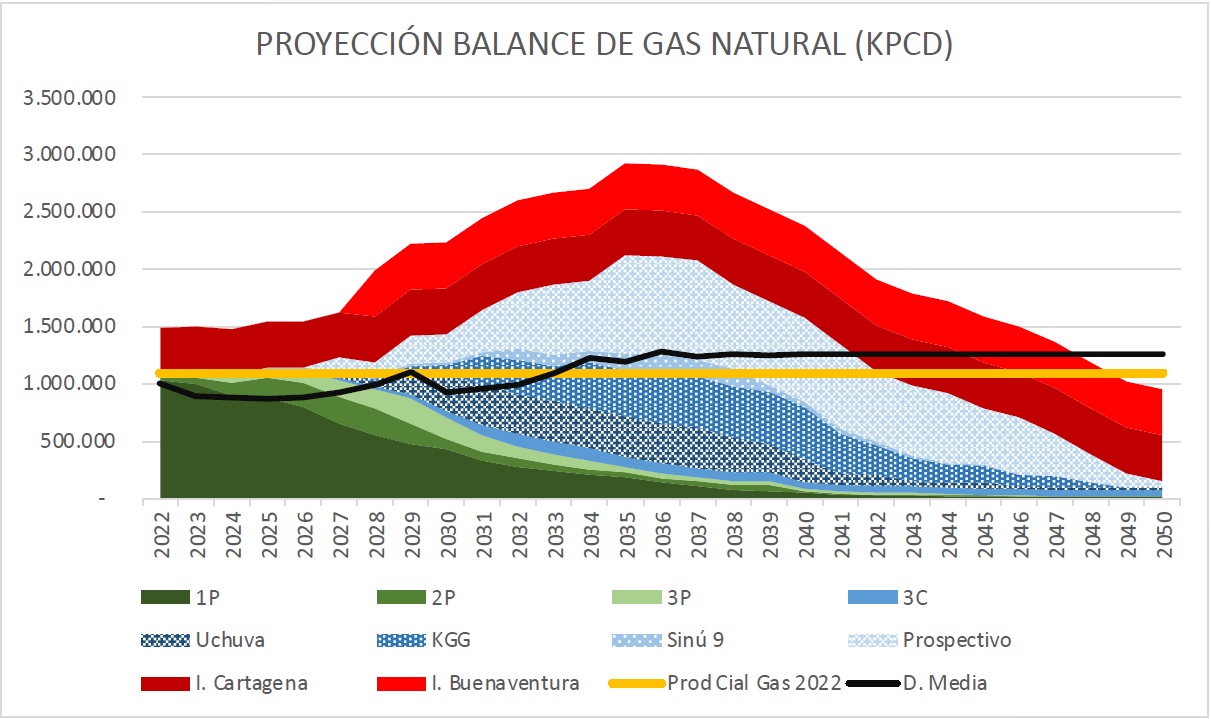

This chart comes from a MinEnergia study released just before Christmas. I would love this graph to be true. Really. No need for gas imports until 2042? Export capability until that time? Fantastic! Don’t get me wrong.

“Reyes” have passed, marking the end of the holiday period in Colombia. Nothing left to do but start 2023 and, for Hydrocarbons Colombia, to make some bold assertions, almost certain to be wrong (if past performance is a guide). As always, I hope I err on the side of conservatism.

Being December, this month normally has diminished expectations for progress on any issue. Traditionally, the political and judicial branches shut down around the 15th and nothing much happens until after “Reyes” the holiday corresponding to the Epiphany in Anglo-Saxon countries and which Colombia celebrates on the Monday closest to January 6th. On December 12th, the government and the ELN released a brief press release with limited, mostly procedural, agreements and shut down for the holidays. Then things really started to happen.

This is the last long essay before the holidays and usually I do a “Year in Review”. But we just did a “Petro 100 days” a few weeks ago and we wrapped up the Duque presidency from an oil and gas perspective in July. There frankly is not much new to say looking backwards, so I decided to look forwards somewhat. I attended the Parex Capital Markets Day last week and it got me thinking about why companies invest here.

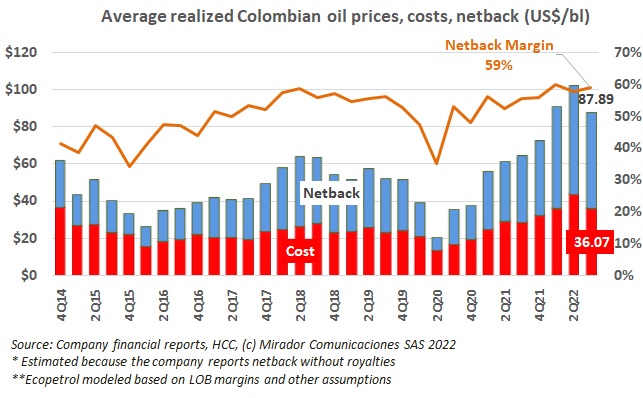

Oil prices fell in 3Q22 (you knew that) and so, as a consequence did netback. The good news is that margins have held largely constant this year, even up very slightly on average in the past quarter. As always we repeat the “EPA caveat” that individual company results may vary from this cross-industry comparison.