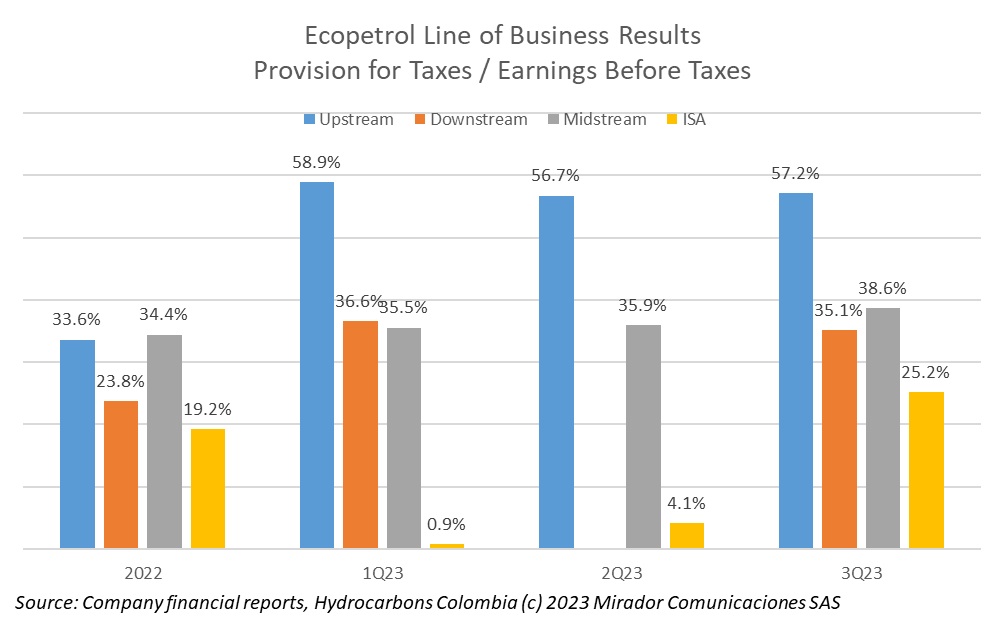

Just as we were about to write about the impact of taxes on Ecopetrol’s 3Q23 results, the Colombian Constitutional Court decides to undo the royalty no-deductibility rule from last December’s tax reform. Instead, we will briefly discuss the tax impact and then focus on ECP’s results, which got the press’s negative attention. Very happy to have to reorient this article in return for what we estimated as US$2B of less tax.

Long-time HCC contributor and industry veteran Tomás de la Calle sent this analysis and commentary on the Petro government’s energy policy. We think you will find it useful.

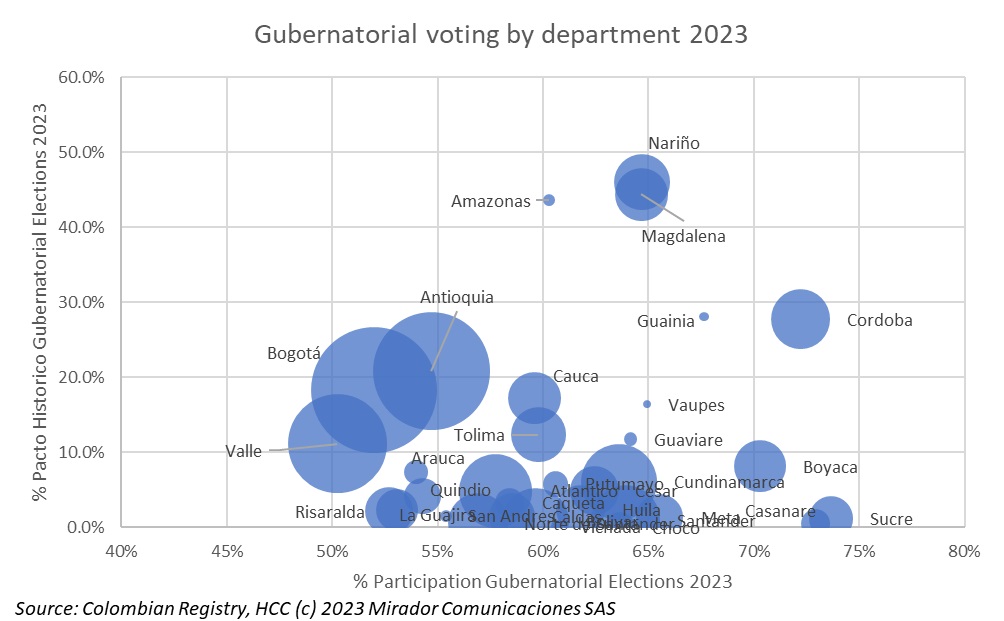

The recent local elections and major setbacks in President Gustavo Petro’s flagship “Total Peace” project should mean a reevaluation of the To Do list but probably it won’t. Unfortunately. Here we look at the election results in more depth.

The lightest peace news month in 2023 meant Colombians focused on other issues, specifically the regional elections that took place on the 29th of October. These could impact President Gustavo Petro’s ability to implement whatever agreements he manages to achieve. UPDATE: On Thursday, November 2, 2023 the High Peace Commissioner Danilo Rueda reported that the ELN were responsible for the kidnapping of Luis Manuel Diaz, father of Colombian international footballer Luis Diaz. This violates the spirit if not the letter of the peace talks (which Rueda’s social media post highlights) so for now we can only say that the impact on the process is unpredictable.

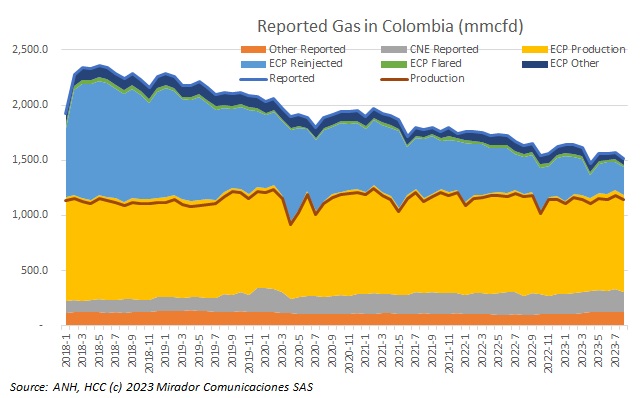

The last week or so was topsy-turvy for Colombian gas with Ecopetrol announcing “the presence of gas” in the Shell-operated Glaucus-1 well but Canacol announcing it had thrown-in-the-towel on its deal with EPM and the associated pipeline connecting Medellin and Jobo. The Canadian E&P simultaneously announced it was limiting its Colombian CAPEX to projects which leverage “existing transportation capacity” and focusing its future-oriented investments on Bolivia. The Canacol announcement will, no doubt, dominate the coffee and cocktail conversations at this week’s Cumbre de Petróleo, Gas y Energía in Cartagena.

This rather succinct but perhaps unpleasant phrase came from an unidentified French cabinet minister, quoted in a The Telegraph article on Great Britain’s broken infrastructure planning process. It seems Colombia’s peers also have great problems with prior consultation and no good solutions.

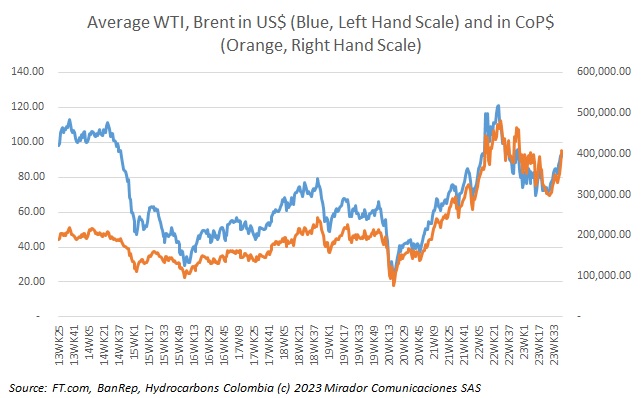

Time was when we could count on a negative correlation between oil prices and the Colombian peso that provided countercyclical relief. Not anymore.

Most of the news this month on the Petro government’s “Total Peace” initiative concerned ongoing battles between the various armed groups with civilians the primary victims. Even the Armed Forces violated its trust. But never mind, the negotiations continue regardless.

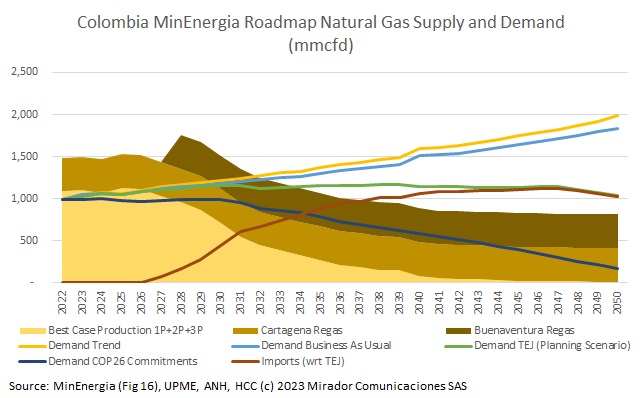

MinEnergia recently published its draft energy transition roadmap and the attention has focused on electrification for good reason: the Colombian government expects a dramatic increase in the proportion of total energy – including transport – served by electricity. For that, we have written extensively in our sister publication ePowerColombia. But the roadmap makes assumptions about oil and gas demand and supply that could impact the hydrocarbons industry.

The news is full of rising prices and their potential impact on gasoline and the upcoming US elections. But as the lead graph shows, oil prices fell during 2Q23 and that had a parallel impact on netback.