More than 40 points of the Catatumba pipeline were detonated over the weekend creating an environmental emergency as crude flows into the surrounding area.

Ecopetrol could have the requirements and details of a modernization project of the Barrancabermeja Refinery ready by the end of the year, which would mean it would award contracts to do the work during 2014.

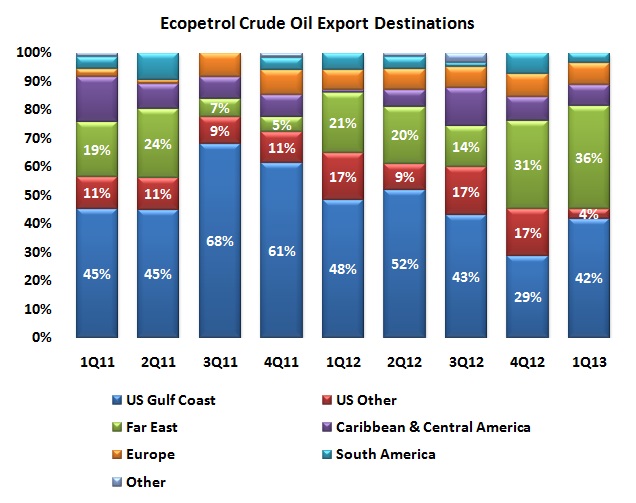

Every quarter Ecopetrol helpfully publishes the distribution of its crude oil exports. Other producers would have different profiles but considering the NOC’s size both in terms of production and commercialization, this is a good indicator of the country as a whole.

The Minister of Mines and Energy Federico Renjifo told bankers at a recent banking convention that growing hydrocarbons production in Colombia requires significant investments in coming years, creating an opportunity for the financial sector.

The Colombian hydrocarbons sector will receive COP10Tr (US$5.26B) in infrastructure investments over the next six years, says the vice minister of energy Orlando Cabrales (formerly the head of the National Hydrocarbons Agency — ANH).

Once fully operational in August, the Bicentennial Pipeline will move 110,000 barrels of oil daily to the expense of around 3300 trucks that will no longer be used to transport crude.

Members of the municipalities of Munchia, San Luis de Paleque and Trinidad have met with oil company representatives to discuss the poor quality of the department’s roads.

Infrastructure investments in projects such as highways or added port facilities are required in order for Colombia to continue growing from mining and hydrocarbon production, according to Colombia’s Petroleum Association (ACP).

The Bicentenary Pipeline says it has not only delivered on obligations to improve and maintain roads used for the project’s construction, it went on to improve rural roads of communities affected by the pipeline’s installation that were not required by law.

Javier Gutierrez, president of Ecopetrol, made a visit along with company directors to inspect the progress of the Bicentenario Pipeline in the departments of Casanare and Arauca, saying it’s “weeks” from being operational.