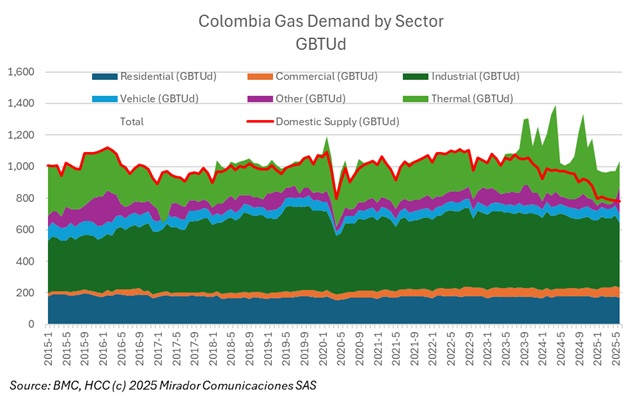

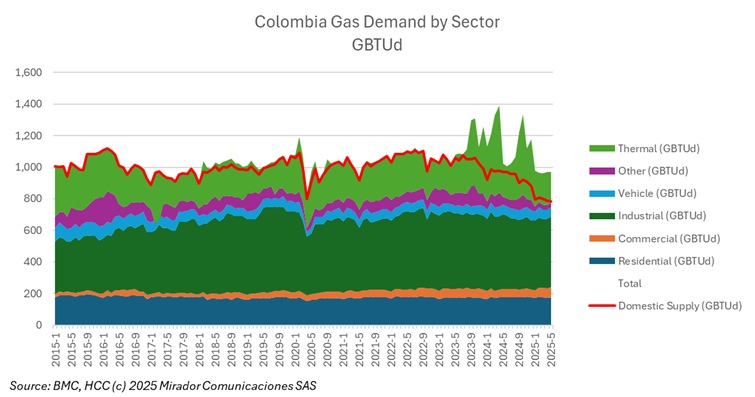

Gas supply continues to fall while gas demand rises. The obvious consequence is that imports rise and thus the average cost of gas. The Petro government has even stopped saying that everything is under control or threatening to fine E&Ps that “waste” gas. Where did it go?

In a landmark effort to boost Colombia’s energy transition, the National Hydrocarbons Agency (ANH) and the Industrial University of Santander (UIS) have unveiled the results of a comprehensive research initiative aimed at identifying real, science-backed opportunities for decarbonization and efficient use of national resources.

At the IV Forum on Sustainability Achievements, Jorge Henao, President of Transportadora de Gas Internacional (TGI), outlined two urgent regulatory measures needed to ensure energy security, expand natural gas coverage, and secure long-term supply for Colombia.

While Colombia grapples with uncertainty in the natural gas market, the government is offering reassurance on the availability of propane, a key energy source for millions of households.

Colombia will need to keep importing natural gas in 2026 to meet domestic demand, according to figures from the country’s Gas Market Operator.

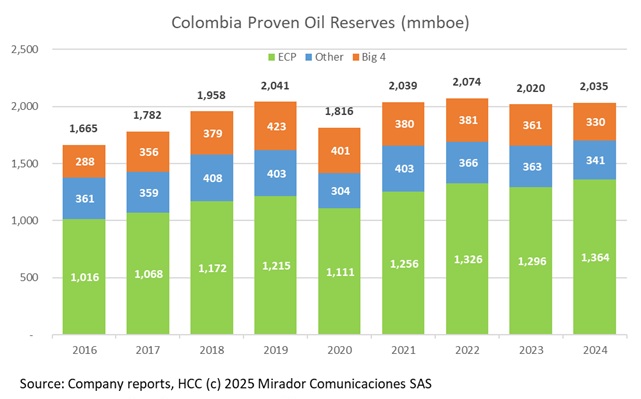

We cannot really blame Orlando Velandia and the ANH for spin-doctoring the recent oil and gas reserves report. His ultimate boss, Colombian President Gustavo Petro, doesn’t need any more bad press. But second derivatives, while interesting, do not tell the story.

Colombia’s Superintendency of Public Services (Superservicios) has once again raised concerns over what it calls an unjustified increase in natural gas tariffs, which began in December 2024.

Despite positive developments in Colombia’s oil sector, energy analysts continue to raise red flags over the country’s gas reserves.

For the first time in 25 years, Cristina Mendoza no smells of smoke. Her kitchen in Palmar de Varela, Atlántico, no longer fills with the gray haze of burning firewood. Instead, a clean, blue flame now fuels her stove, a modest change for some, but a life-changing transformation for thousands of families across Colombia.

The Colombian Natural Gas Association (Naturgas) issued a stark warning following the release of a new report showing a 13% drop in the country’s proven natural gas reserves in 2024.