The NOC will start developing Fracking Research Pilot Projects (PPII) by the end of next year, CEO Felipe Bayón said.

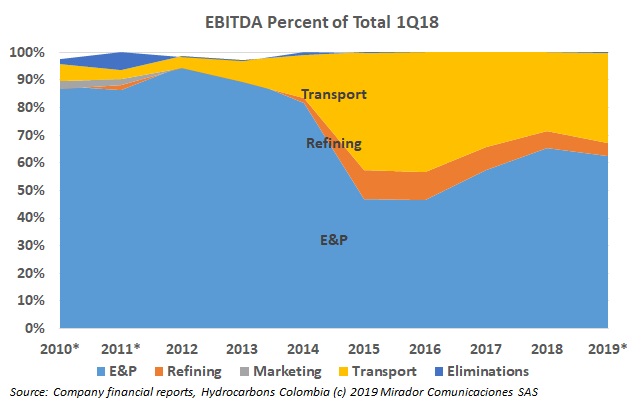

Ecopetrol’s 9-month results to September 2019 show that, once again, the Transport Line-of-Business (LOB) has compensated for lower oil prices and poorer margins in the Refining LOB. Ecopetrol (NYSE:EC)

Ecopetrol (NYSE: EC) started an international expansion campaign, and unconventional projects have played a key role in this process. The NOC spoke about its achievements in the US.

The Minister of Mines and Energy (MinEnergia), María Fernanda Suárez, spoke about fracking regulations, and gave dates for the start of fracking pilot projects.

The Ministry of Finance (MinHacienda) asked Ecopetrol (NYSE: EC) for more money.

Ecopetrol (NYSE: EC) decided to leave Hocol in charge of a very important segment for the future of its business group.

The NOC will invest up to US$140M for the evaluation and development of Fracking Research Pilot Projects (PPII), CEO Felipe Bayón said.

Ecopetrol (NYSE: EC) started an international expansion campaign in countries like the US, Mexico and Brazil. The NOC announced positive results.

Ecopetrol’s subsidiary, Hocol, confirmed that it bought Chevron’s (NYSE: CVX) participation in two gas fields in the Caribbean region.

The company announced its investment budget for next year. Ecopetrol (NYSE: EC) aims to start developing Fracking Pilot Research Projects (PPII) next year.