Public order issues halted production at Ecopetrol’s (NYSE:EC) Yariguí-Cantagallo field. The development of these and other stories in our periodic Security summary.

The Colombian Corporate Regulator (SuperSociedades) published its report on the 1,000 largest companies in Colombia. Results from industry firms like Ecopetrol (NYSE: EC) and Reficar stood out.

The government filed the draft for next year’s budget. Opinions about selling State assets like Ecopetrol (NYSE: EC) to finance the country’s expenses are still divided.

The NOC responded to the USO’s complaints about an alleged mishandling of the Covid-19 pandemic.

Ecopetrol (NYSE: EC) announced a successful work completion on its Prime G plant in the Barrancabermeja Refinery.

At least that is my – perhaps naïve – hope. The ACIPET’s plea to not sell even 8% of Ecopetrol and recent events at Pemex and PDVSA have me thinking again about politicians’ love of state-owned-enterprises (SOEs) at least in some countries like Colombia.

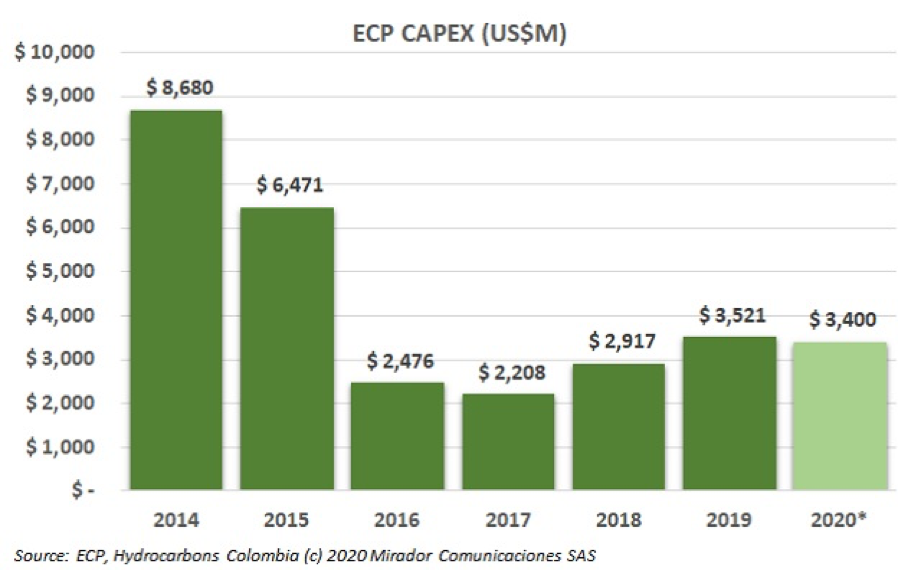

Ecopetrol’s (NYSE: EC) Board of Directors approved a new investment plan for the company.

The union denounced that workers who go to Ecopetrol’s (NYSE:EC) clinic in Barrancabermeja allegedly get Covid-19, due to the high number of doctors that carry the virus at the facility. Here are the details.

CEO Felipe Bayón spoke about Ecopetrol’s (NYSE:EC) plans for the development of fracking pilot projects (PPII).

Ecopetrol (NYSE: EC) will finance part of the dredging process that will assure navigability on the Magdalena river, between the oil port in Barrancabermeja (Santander) and Reficar (Cartagena).