Ecopetrol Óleo e Gás do Brasil Ltda. (ECP Brasil), a subsidiary of the Ecopetrol Group, approved the Final Investment Decision (FID) for Gato do Mato, its first development project in the pre-salt area of the Santos Basin, Brazil.

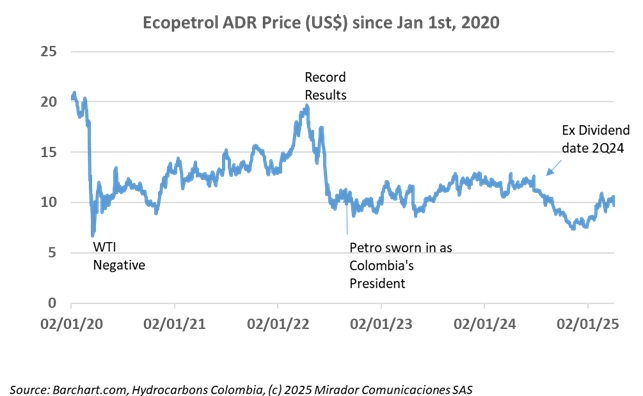

Investment bank Citi has outlined the factors influencing Ecopetrol’s (NYSE: EC) investment potential, setting a target price of US$14 per ADR on the New York Stock Exchange with a recommendation to buy, albeit with high risk.

The Colombian government, under President Gustavo Petro, has approved an ambitious project to establish the first technological infrastructure line in Santa Marta, integrating advanced artificial intelligence (AI) capabilities.

The BBC has revealed that, according to leaked data from a former Ecopetrol employee, Colombia’s state-owned oil company allegedly contaminated various sites with oil, including water sources and biodiverse wetlands.

Ecopetrol’s General Shareholders’ Meeting approved the full list of nine persons who will constitute the company’s new Board of Directors.

The upcoming Ecopetrol General Assembly, scheduled for today, is set to be marked by shareholder discontent over a significant dividend reduction.

Fitch Ratings has downgraded Ecopetrol’s outlook from stable to negative, aligning it with Colombia’s sovereign rating review.

Ecopetrol (NYSE: EC) announced the opening of its internship program for 330 students looking to complete their practical training in the second half of 2025.

Colombian President Gustavo Petro reiterated the need for Ecopetrol (NYSE: EC) to drive the country’s energy transition.

Ecopetrol’s President, Ricardo Roa Barragán, addressed speculation surrounding the Sirius gas wells (formerly Uchuva), located in the Colombian Caribbean Sea.