Ecopetrol (NYSE:EC) signed a US$300M loan with the Export Development Canada (EDC) agency, which it says meets half of its financing goal for 2016 and demonstrates the continued trust that the market has in its operation.

Ecopetrol (NYSE:EC) has reorganized its board of directors, with the former Colombian ambassador to Venezuela Carlos Cure taking the role of president, replacing the former Minister of Defense Luis Fernando Ramírez.

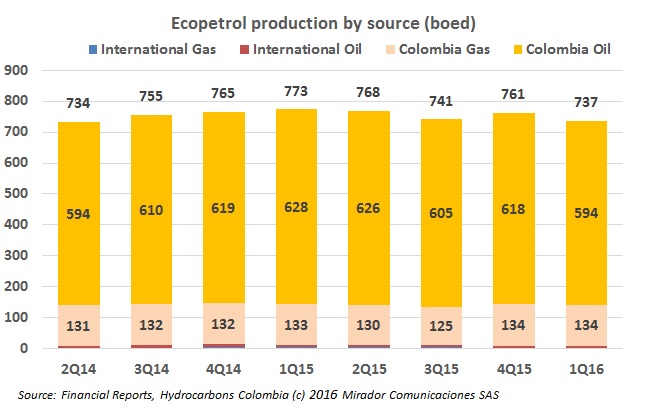

Ecopetrol (NYSE:EC) once again posted a profit in the first quarter of 2016 of CoP$363B (US$123.7M), as its transport business benefits its bottom line, coupled with cost cutting and a favorable exchange rate.

Facing mounting criticism for cost overruns and poor contracting practices, Ecopetrol (NYSE:EC) president Juan Carlos Echeverry said the NOC is implementing a new strategy for how it purchases goods and services and manages its projects.

Ecopetrol’s (NYSE:EC) former president Javier Gutiérrez defended his actions involving the Cartagena Refinery (Reficar) while at the helm of the NOC, and said without the controls he enacted, the cost could have been worse.

USO president Cézar Loza warned that Ecopetrol (NYSE:EC) president Juan Carlos Echeverry and its board of directors have a plan to dismember the NOC and sell it off like the government did with energy producer Isagén.

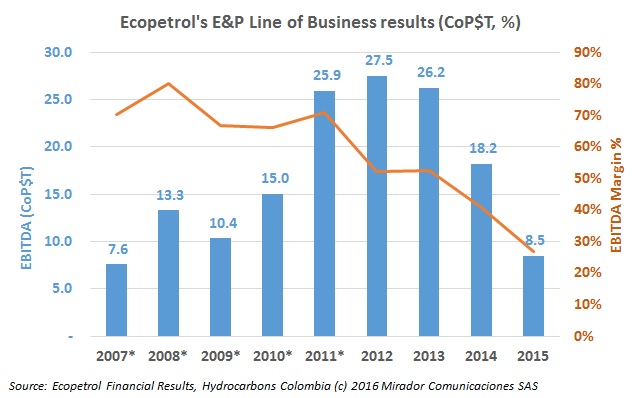

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry said that the firm does not see short term relief in the price of crude, and that it will continue “in crisis mode” for the foreseeable future, even for the next five years.

Repeated calls for action from national authorities from Barrancabermeja politicians and residents earned them a meeting with Ecopetrol (NYSE:EC) president Juan Carlos Echeverry. The NOC chief did not budge on decisions to not modernize the city’s refinery, but said it remains a strategic asset for the firm.

A sharp drop in attendance and calls of protest were two of the main takeaways from Ecopetrol’s (NYSE:EC) annual shareholder meeting held last week. Minority shareholders protest as the board of directors vote to not pay dividends this year. The NOC says it needs a US$50/barrel fuel price to reactivate shuttered fields.

Ecopetrol’s president Juan Carlos Echeverry offered a spirited defense of the Cartagena Refinery (Reficar) and its modernization at the recent Congress of the Colombian Natural Gas Association (Naturgas), highlighting that despite the bad press, the project moves forward and is nearly 100% operational.