The Association of Colombian Oil Engineers (Acipet) says that there is a deceleration occurring in the oil industry resulting from the saturation of investment and the price of crude internationally.

Colombia’s oil industry has marked sustained growth over the last several years, but if the prospects of the industry are to continue into a bright future, more reserves must be discovered and added to its ever shortening supply looking forward.

An article in the local paper Noticiero del Llano quoting unnamed “ecologists” is calling on Ecopetrol to assume the social responsibility of exploration and production, and called on readers to voice concerns to a mobile unit of the NOC designed to receive complaints from the community.

Ecopetrol (NYSE: EC) spoke to investors last week and one of the upbeat stories was about exploration, something the NOC often gets criticized for.

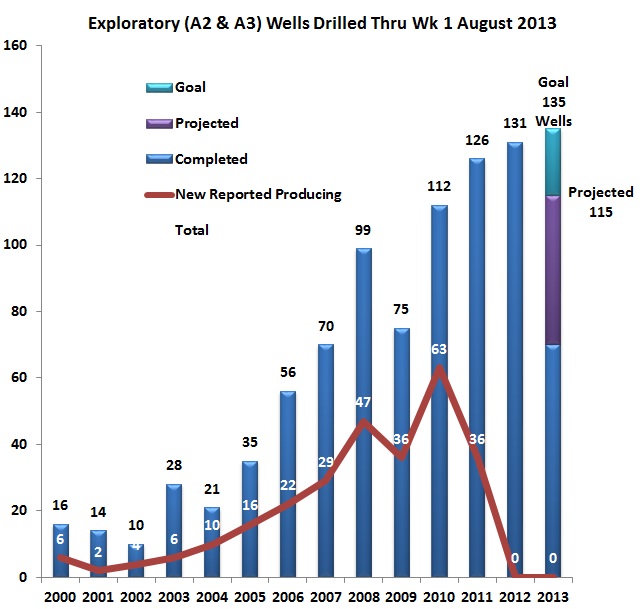

The president of the Colombian Petroleum Association (ACP) Alejandro Martínez believes that not only will the number of exploratory wells in Colombia fall below expectations, it will come in below 2012 levels also.

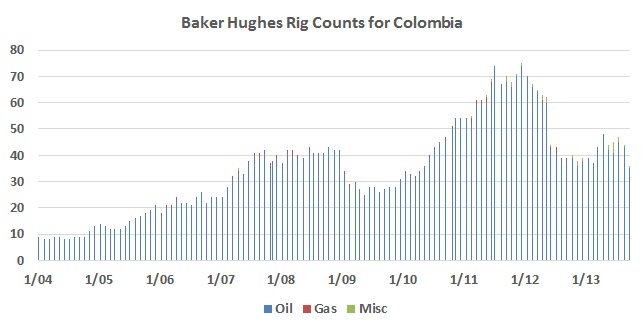

Drilling services giant Baker Hughes recently published its international counts of active drill rigs. At 36, the Colombian count has not been this low since May 2010.

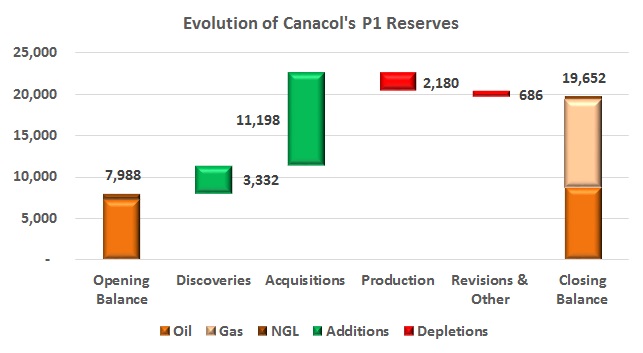

Canacol’s year end is June 30th and it recently published its Annual Information form with Canadian securities regulators. Its proven reserves grew organically 24% and the Shona purchase allowed reserves to nearly triple.

No this is not the flag of some new country. Not even a new region of Colombia. It certainly is not the flag of the region from the eastern cordillera to the Venezuelan border that the Farc and ELN have generously offered to run on behalf of the Colombian people in a post conflict scenario.

New technologies, off shore drilling and unconventional reserves must be actively harnessed and explored if Colombia is to maintain its oil production above a million barrels a day says Germán Arce, president of the National Hydrocarbons Agency ANH.

A technical issue caused the original article to have incorrect conclusions. It has been re-issued here. We apologize for any misunderstanding this might have caused.