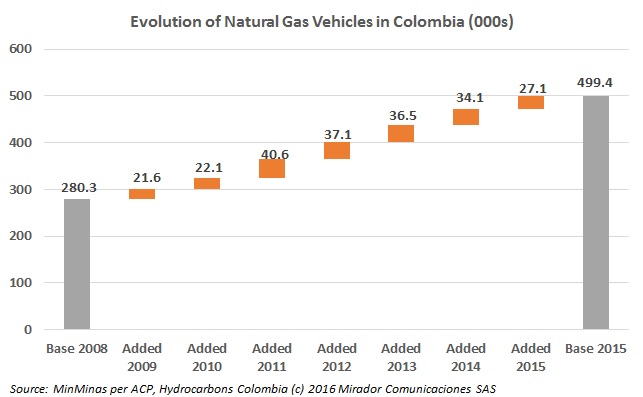

The number of vehicles converted to natural gas continues to grow, albeit at a slower and still slowing rate. Does supply uncertainty play a role?

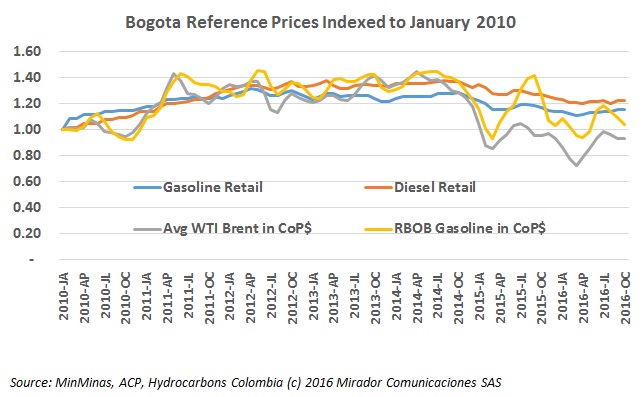

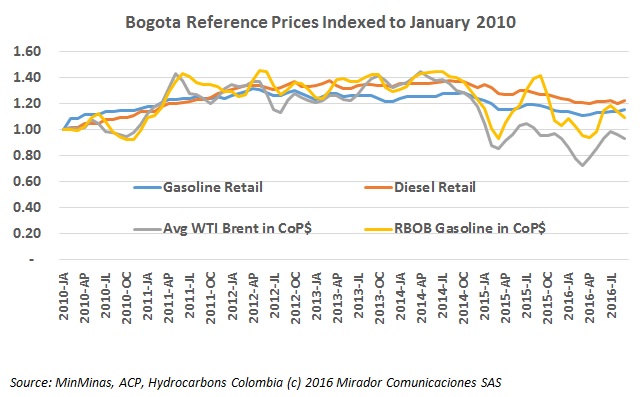

The administration of the Minister of Mines and Energy Germán Arce has opted for a different approach to figuring monthly fuel prices to keep the changes to the minimum, and is now studying how to change the pricing formula to remain as stable as possible.

The Ministry of Mines and Energy (MinMinas) has frozen the price of biofuels which it uses in its special fuel price formula. Palm growers and their association Fedepalma rejected the measure and warned that it will bring substantial losses for their industry.

The Ministry of Mines and Energy (MinMinas) left fuel prices untouched for the month of October, with observers saying that stable international prices do not make it necessary to adjust Colombia’s prices.

The Cartagena Refinery (Reficar) expansion is not enough, warns the Colombian Petroleum Association (ACP), and if refining capacity is not expanded, by 2040 Colombia could be importing half of its fuel and gasoline.

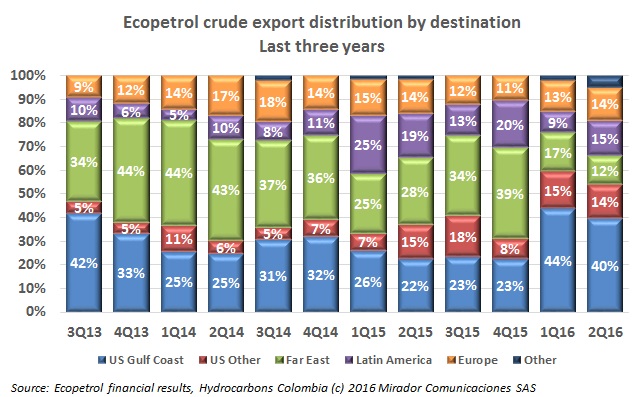

During the first half of 2016, crude exports from Colombia to the United states increased by 82,000bd, to reach a total of 520,000bd. This amounts to a 18.72% increase compared to the same period last year.

Pending changes which will be announced by the Energy and Gas Regulation Commission (CREG) between October and November could mean lower biofuels rates, which has producers concerned.

The Ministry of Mines and Energy (MinMinas) published fuel prices over the weekend for September 2016, which include an rise in both gasoline and diesel, citing increases in crude and biofuels prices.

Colombia and Peru have received more interest from foreign investors as traditional markets like Brazil and Mexico have been hampered by economic problems. But despite this positive news, Latin America still ranks low as a priority for global investors, according to a recent survey.

The constant decline of existing gas fields like those in La Guajira, and a lack of new sources has spelled the end to an expansion of thermal generation plants designed to back up the general electrical grid.