Last week’s article on long-term oil prices did not get a lot of readership. Maybe it was too heavy on the data analysis and too light on policy recommendations. This article focuses on policy.

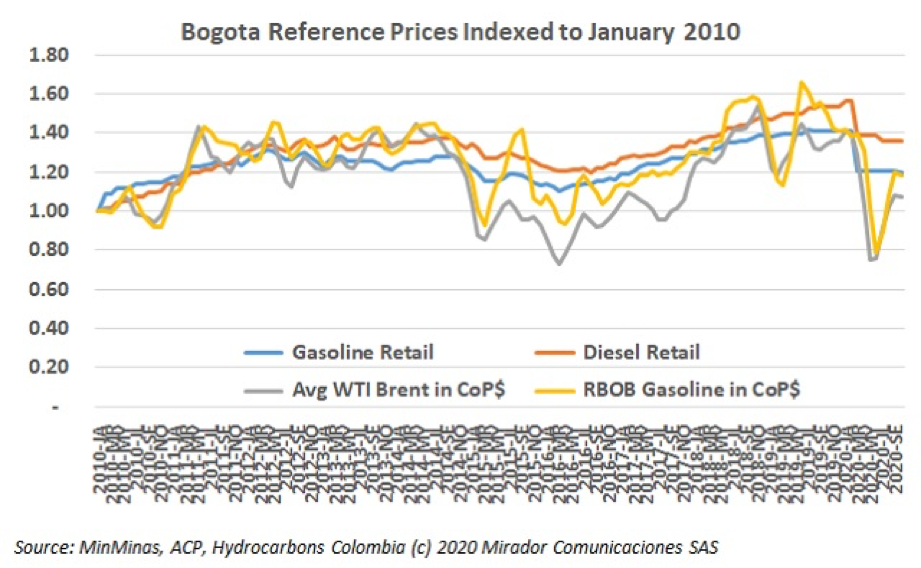

The Ministry of Mines and Energy (MinEnergia) announced fuel prices for October 2020.

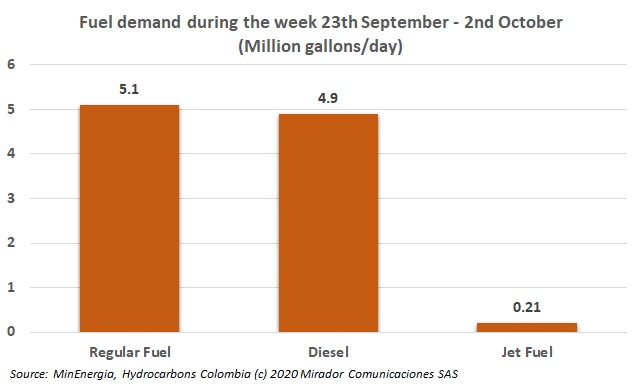

The Ministry of Mines and Energy (MinEnergía) delivered a report on gasoline consumption for September and October 2020.

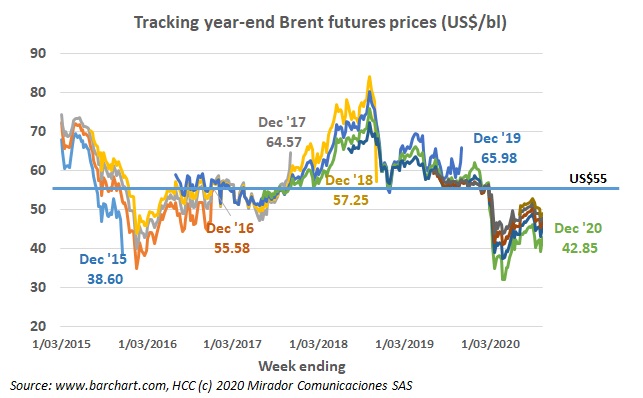

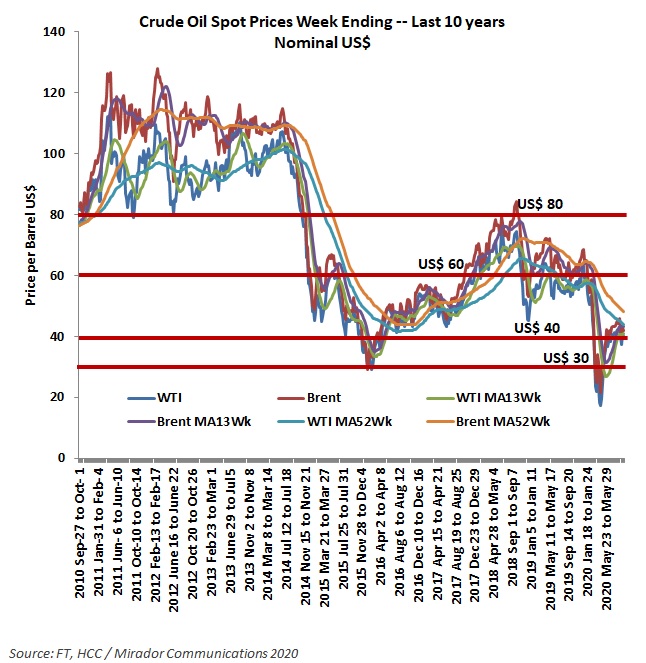

Spot prices were up last week but President Trump’s physician has more influence over that than demand or supply fundamentals. Our long-term indicators are not going in the right direction.

Oil prices dropped as increases in Covid-19 cases threaten the world’s economy, once again.

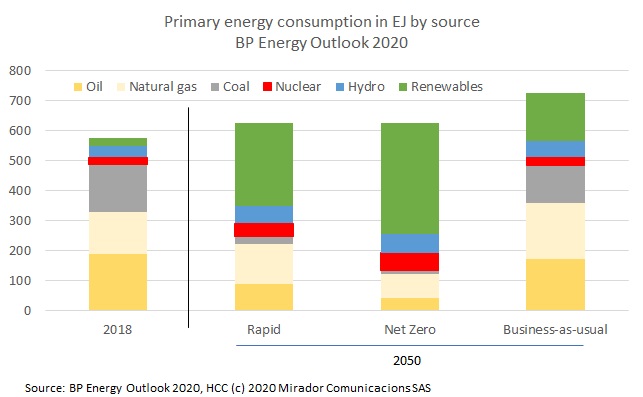

We normally do not write about global issues – we assume that you have your own sources for this information. But BP recently published its Energy Outlook after a long, Covid-19-induced delay, and, if an accurate reflection of the future, there are profound implications for the industry and for Colombia.

The Ministry of Mines and Energy (MinEnergia) announced fuel prices for September 2020.

The Ministry of Mines and Energy (MinEnergia) announced fuel prices for August 2020. Here are the details.

The National Federation of Fuel and Energy Distributors (Fendipetróleo) warned about the “critical scenario” that fuel distributors are currently facing in Colombia.

Ecopetrol (NYSE: EC) announced a successful work completion on its Prime G plant in the Barrancabermeja Refinery.