Ecopetrol achieved a significant sustainability milestone by contracting a vessel equipped with an auxiliary wind propulsion system, reducing CO2 emissions by 49% compared to conventional ships.

The Ministry of Mines and Energy is working on a comprehensive update of the institutional framework to guarantee liquid fuel supply in Colombia. The initiative will be built on two main pillars: strengthening the legal and operational framework for fuel imports, and creating a Liquid Fuels Manager.

The import of fuels in Colombia has increased nearly tenfold in the last decade, according to an alert issued by the Comptroller General, Carlos Hernán Rodríguez.

Colombia’s supply of propane is entering a critical phase as natural declines in producing fields and lower availability from refineries are tightening domestic output.

A high-stakes tax dispute between Colombia’s tax authority (DIAN) and Refinería de Cartagena (Reficar), the Ecopetrol (NYSE: EC) subsidiary that supplies more than half of the country’s diesel and a third of its gasoline, has triggered fears of an operational shutdown that could threaten the nation’s fuel supply.

Colombian drivers will feel another pinch at the pump starting Friday, October 24, as the Energy and Gas Regulation Commission (CREG) announced an increase in fuel prices.

Ecopetrol (NYSE: EC) President Ricardo Roa announced that the company is nearing financial closure on two of its most important natural gas infrastructure projects: the Buenaventura and Coveñas regasification terminals. Both are seen as key components of Colombia’s energy transition strategy and its efforts to secure long-term gas supply.

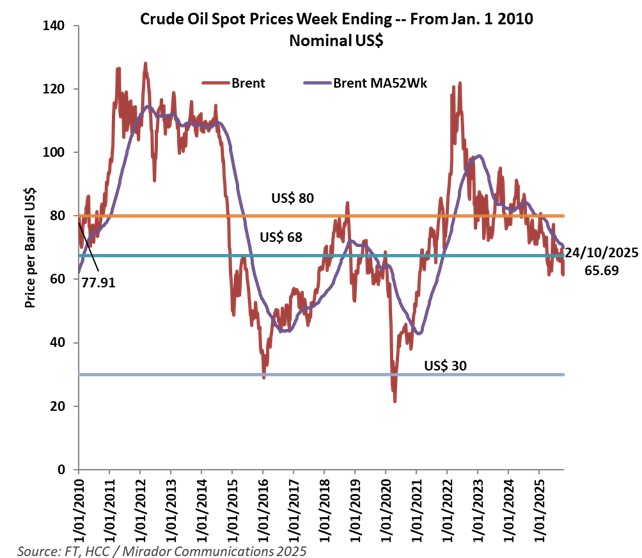

Ok. Last week, Brent went up in response to rising geopolitical tensions. But the fundamentals point in the other direction. OPEC wants to raise production to force out marginal E&Ps and the International Energy Agency predicts a “glut” next year. How far will prices fall and will that force Colombian producers out of the market?

The recent contingency at SPEC LNG, Colombia’s only regasification terminal, offered a stark reminder of how fragile the country’s energy system can be.

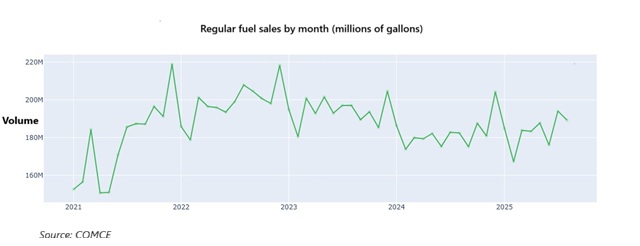

Even as questions grow over Colombia’s declining oil production and the country’s future energy self-sufficiency, domestic fuel consumption continues to climb. According to the latest report from the Confederation of Fuel and Energy Retail Distributors (COMCE), demand for gasoline and diesel surged in the third quarter of 2025, with premium gasoline posting record growth.