DIAN notified Ecopetrol of Resolution 000571 confirming a CoP$5.3T sanction (including interest and penalties) related to 19% VAT on gasoline imports between 2022-2024, escalating the ongoing legal dispute between Colombia’s tax authority and the state oil company.

Colombia’s liquid fuels market closed 2025 with positive consumption figures driven primarily by diesel demand, though profitability deteriorates for distributors despite sales growth, according to a report presented by Somos Uno—the trade association uniting Comce Colombia and Fendipetróleo Nacional.

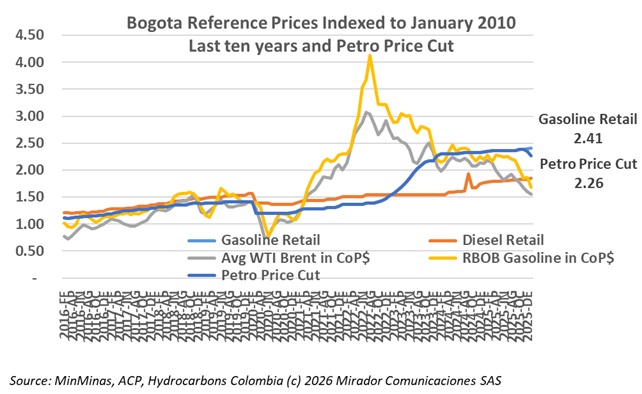

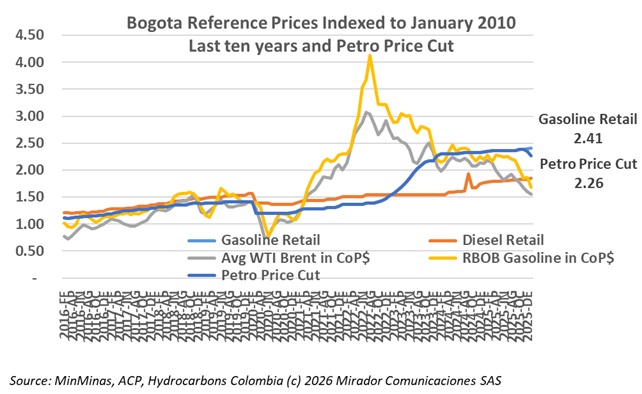

Energy Minister Edwin Palma signed a resolution making effective a CoP$500 per gallon gasoline price reduction beginning February 1, 2026, while maintaining stable diesel prices.

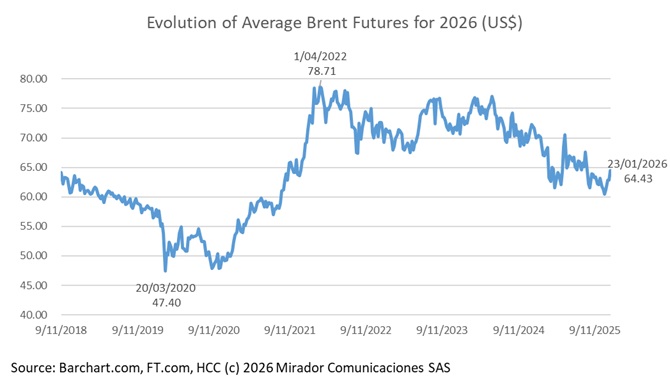

Fitch Ratings’ ‘neutral’ 2026 outlook for the global Oil & Gas sector reflects its assumption that the Brent oil price will average about USD63/barrel, down from USD69/barrel in 2025, with geopolitical risks supporting prices while large oversupply constrains them, Fitch says in a report published today (December 12, 2205).

Colombia’s Superintendency of Corporations (Supersociedades) chief Billy Escobar revealed that state-owned enterprises Industria Militar (Indumil) or Ecopetrol could acquire struggling fertilizer manufacturer Monómeros if U.S. sanctions are lifted.

President Gustavo Petro announced Colombia will begin reducing gasoline prices after fully settling the Fuel Price Stabilization Fund (FEPC) debt that reached approximately $70 trillion inherited from the previous administration.

Chevron announced plans to invest over US$20M during the next five years to improve operational capacity and guarantee fuel supply in Colombia, following its 2020 exit from natural gas exploration and production to focus on becoming a leading fuel and lubricant provider.

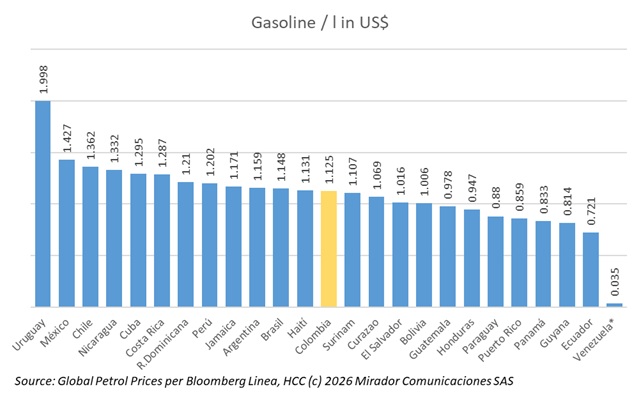

Gasoline prices vary dramatically across Latin America, with the global average at US$1.28 per liter, according to Global Petrol Prices data for early 2026.

Colombia’s vehicular natural gas prices increased 80% between 2022 and 2026, rising from approximately CoP$1,930 per cubic meter to nearly CoP$3,490, with annual average increases of 18% confirming a sustained upward trend at service stations.

Following political upheaval in Venezuela in early January 2026, global petroleum markets are undergoing significant realignments as major players position in the new landscape. President Trump announced substantial U.S. investment plans while Canada, Mexico, India, and China reassess their energy strategies in response to Venezuela’s changing landscape.