According to Colombia’s Superintendente de Sociedades Billy Escobar, Canacol Energy’s cross-border reorganization process is advancing with a proposed US$67M financing package that could enable the Canadian gas producer to exit insolvency by late 2026. Publishing this because we get questions and some of you may not have seen this interview, but we cannot vouch for the information because this does not come from company press releases. Caveat Lector.

Ecopetrol and the José Benito Vives De Andréis Marine and Coastal Research Institute (Invemar) signed a renewed collaboration agreement to advance knowledge generation and conservation of Caribbean seabed ecosystems, building on their existing framework partnership.

NG Energy published a press release on the results of AGM and a special shareholders meeting held January 22nd.

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent energy company with over 20 years of successful operations across Latin America, announces its operational update for the three-month period ended December 31, 2025 (“4Q2025”).

Martín Fernando Ravelo assumed the presidency of Colombia’s Unión Sindical Obrera (USO), the country’s largest petroleum workers union, replacing César Loza who was elected to represent workers on Ecopetrol’s board of directors.

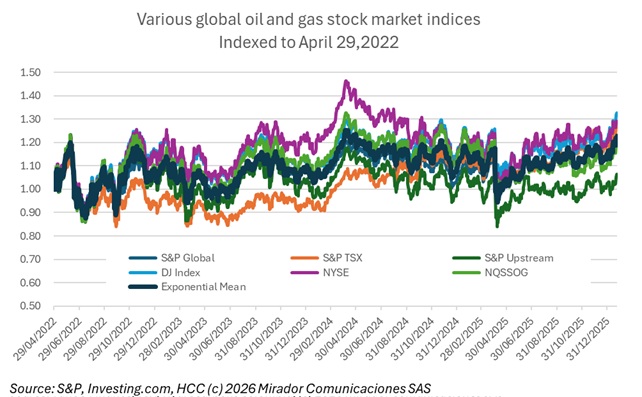

A new year and we thought we should do an update / upgrade to our index of Colombia-focused publicly listed oil and gas companies.

Colombia’s dollar has weakened to around CoP$3,650, its lowest level since President Gustavo Petro took office, but market analysts warn the exchange rate is artificial and disconnected from economic fundamentals.

Ecopetrol called an extraordinary shareholders assembly for February 5, 2026 at 8:00 AM to elect nine board members for terms extending through 2029, following the departures of Mónica de Greiff and Guillermo García Realpe. The completed slate features historic worker representation alongside technical expertise spanning the energy sector.

Chevron announced plans to invest over US$20M during the next five years to improve operational capacity and guarantee fuel supply in Colombia, following its 2020 exit from natural gas exploration and production to focus on becoming a leading fuel and lubricant provider.

Drummond Company announced that on January 15, 2026, a jury in the U.S. District Court for the Northern District of Alabama returned verdicts against attorney Terrence P. Collingsworth and his organization International Rights Advocates (IRAdvocates) on all counts in defamation and racketeering lawsuits. The plaintiff had accused the company of supporting armed groups in Colombia.