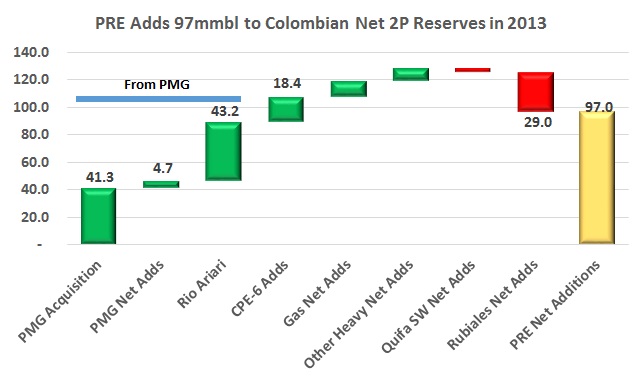

Pacific Rubiales reported its 2013 Colombian 2P reserves which increased 97mmboe or 22%. The graph shows the Petrominerales acquisition was critical to this, contributing 89 of the 97mmboe.

The continued conflicts in the municipality of Acacias and Castilla La Nueva have led to blockades, riots with police and now Ecopetrol (NYSE:EC) has terminated 45 contracts associated with projects in the area.

The Arbitration Tribunal of Bogotá’s Chamber of Commerce sided with Ecopetrol in a prolonged dispute over the formula used to figure payments received from Pacific Rubiales (TSX:PRE) in the Quifa field.

Venezuela’s Minister of Oil and Mining Rafael Ramírez says he is certain that Venezuela will stop buying natural gas from Colombia in August of this year and is nearly ready to start sending gas to Colombia as had been previously agreed.

Pacific Rubiales Energy (TSX:PRE) will increase its purchases of goods and services in in 2014 to US$5B, a US$1B increase over 2013 as it looks to meet exploration and production goals for the year.

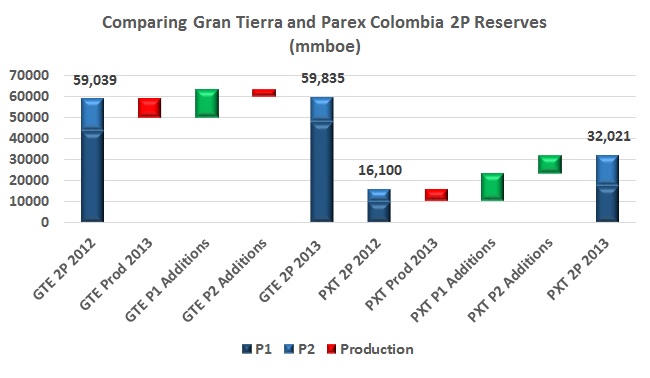

Gran Tierra (TSX:GTE) had teased us with an announcement about its reserve additions in Peru but this week both it and Parex (TSX:PXT) published their full reports on reserves, including detail on Colombia in the case of GTE.

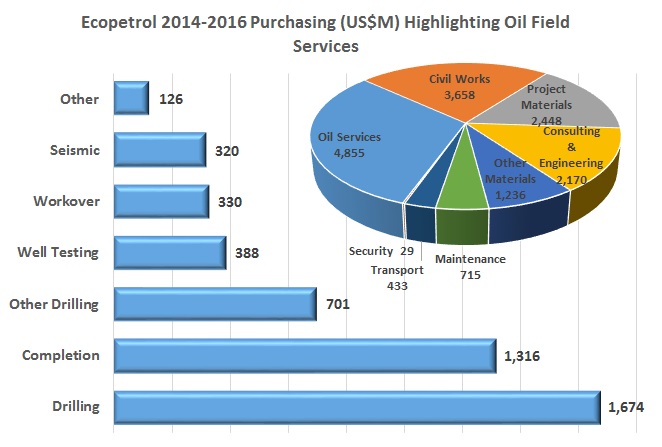

Recently Ecopetrol (NYSE:EC) gave its annual purchasing strategy presentation to its accredited providers. The chart shows a pie chart of all purchases as well as a breakdown of the Oil Services category.

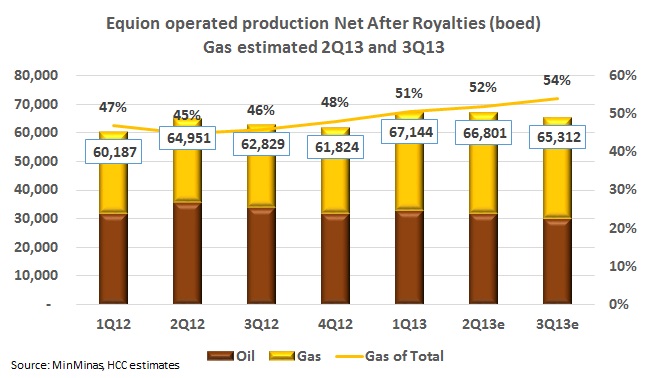

Oil producer Equion says it expects net oil production in 2014 to increase slightly to 27,900bd in 2014, compared to 27,000bd in 2013, and addressed accusations that seismic exploration is affecting the environment in Casanare.

Following accusations that its contracting process of transportation firms is excluding local, small and medium sized companies Ecopetrol (NYSE:EC) has suspended the contract process for two months while it reviews the terms and conditions.

This Friday, January 31 Pacific Rubiales (TSX:PRE) and Ecopetrol (NYSE:EC) will meet to review the future of the production contract on the Rubiales field, which is set to expire in May 2016 and has been a lightning rod for political grandstanding in the last few months.