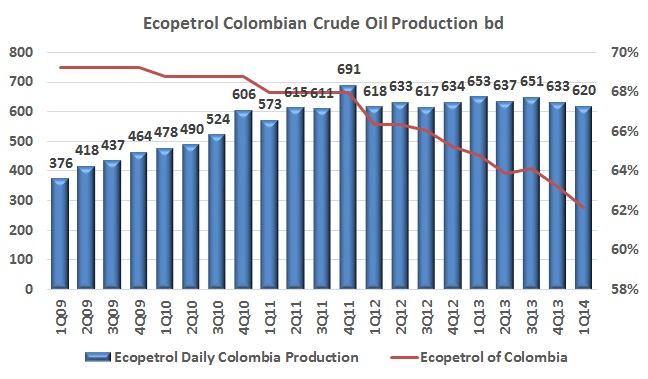

Ecopetrol (NYSE:EC) confirmed that the operational reality on the ground is cutting into its production abilities, which has coupled with increased costs and lower oil prices for a rough first quarter 2014 for the NOC.

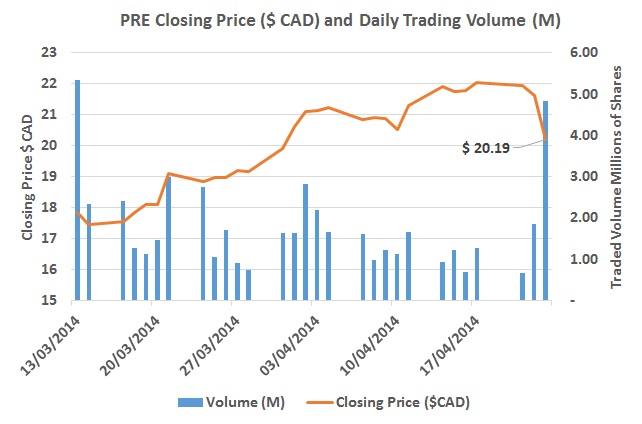

Unusual seismic readings in the company’s most important territory of Puerto Gaitan, Meta and a 1Q14 operations update saying that the company’s largest field, Rubiales, will have lower production again this quarter seem to have spooked investors.

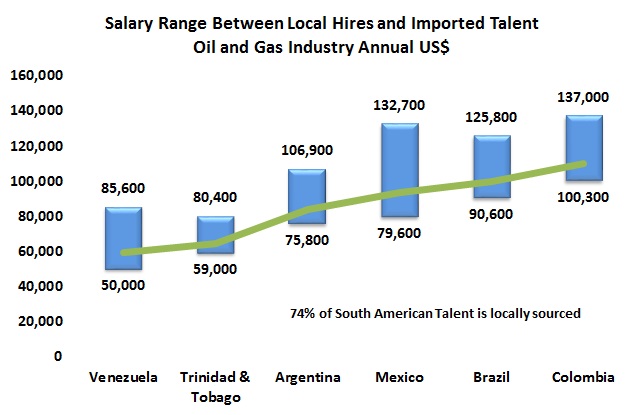

The annual study by global recruiting firm Hays is always hotly anticipated. We had already tweeted the topline result but here are the details. Required reading for HR professionals and senior managers.

In order to offer current and potential suppliers an updated panorama into different aspects of the oil industry Ecopetrol has agreed with The University of Bogotá Jorge Tadeo Lozano to create a “Supplier’s University”, and will subsidize the cost during the first stage of the project.

Ecopetrol’s (NYSE:EC) transport and logistics spinoff Cenit has celebrated its first year of operations, and hailed the completion of the Bicentennial Pipeline as the highlight for this first year.

Excluding the ‘Additional Participation’ aka ‘Factor X’, average royalty rates in Colombia declined from 16.3% in 4Q12 to 15.5% in 4Q13, reflecting the slow shift in production from Traditional contracts to production from E&P Contracts, and from mature fields to newer fields with lower rates. But the graph shows there is considerable variation around the average.

With an eye on the nearly US$10.6B that Ecopetrol has to invest over 2014 in different aspects of its business, the Colombian Chamber of Infrastructure (CCI) has formed an alliance with the NOC to ensure the hydrocarbons investment plan brings benefits for the sector and oil producer alike.

Colombia state owned electrical transmission company Interconexcion Electrica (ISA) is looking to acquire 5% participation of the Pacific Pipeline as part of a new business venture.

The board of directors of Gas transport firm TGI agreed to pay out 100% of the company’s profits from last year to shareholders, spreading the profits from financial consolidation as the company harnesses the growing gas market.

Investments to meet emissions standards set by the Ministry of Environment and Sustainable development have amounted to a CoP52B (US$26.4M) investment into Ecopetrol’s refinery business, only considering the Barrancabermeja Refinery.