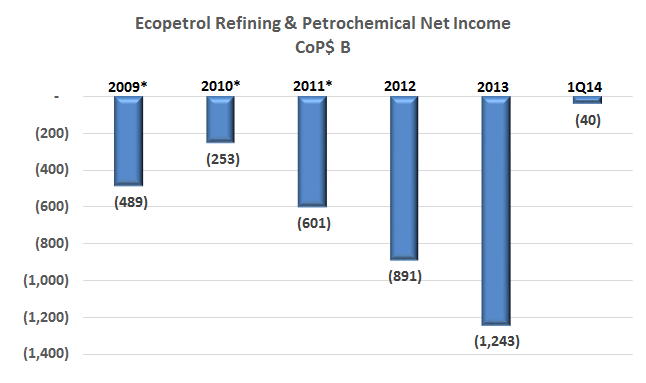

Long a drag on Ecopetrol’s margins, the NOC saw some improvements for its refining business as losses narrowed and the company increased the sales of products like asphalt and jet fuel. But questions still surround what has been the under-performer of the company’s operations.

Vetra Acquisitions has made a bid to take over Suroco Energy (TSX:SRN.V), looking to entice shareholders away from an April agreement with Petroamerica (TSX:PTA) that is to be voted on by shareholders in a June 25, 2014 meeting.

Ecopetrol (NYSE:EC) has unveiled a US$12.8M water injection plant in Huila that it hopes will help keep its production numbers up in the Dina Terciarios field.

Ecopetrol (NYSE:EC) released US$2B in bonds last week which were met with high demand from the market, creating a demand worth more than five times the amount the NOC looked to obtain, or US$10B.

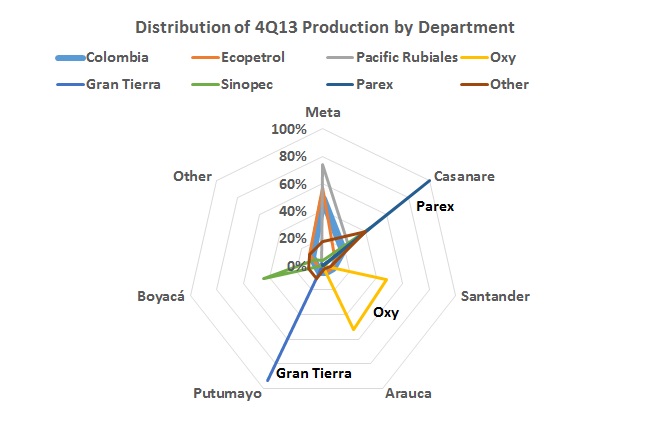

The top 6 producers represented 87% of Colombian production in 4Q13 but it would be wrong to think that they all have their production in the same departments.

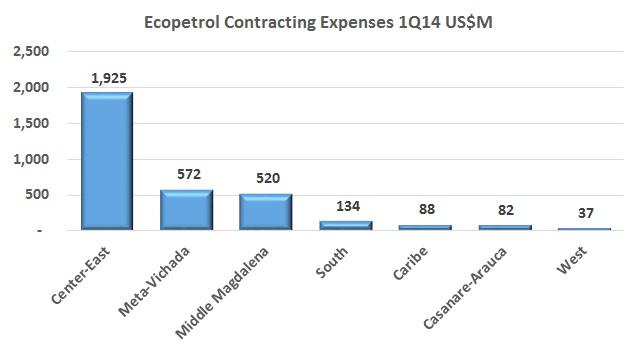

Ecopetrol (NYSE:EC) has released contracting figures for the first quarter of 2014, when the Company contracted 41% more in value terms compared to the same period last year. Bogotá based companies continue to have a greater share of the NOC contracts.

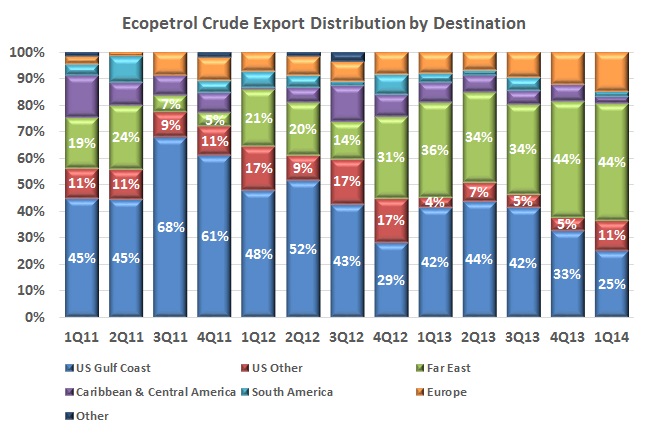

The earnings statement of Ecopetrol (NYSE:EC) confirmed that the Asian market and Far East is now well installed as the prime receiving market for Colombian crude, and the Ministry of Mines and Energy says the trend is true for the mining industry as well.

Our list of corporate social responsibility projects (CSR) over the last two weeks has been dominated by Ecopetrol (NYSE:EC), who has made a splash in local press through a series of different initiatives and projects. A cynic would say, “it must be an election year”, an optimist, “good job”.

The much anticipated and debated future of the Rubiales field appears to have a day of reckoning ahead, with local press saying a decision will be made in June on the future of its production contract, currently operated by Pacific Rubiales Energy (TSX:PRE).

President Juan Manuel Santos visited Villavicencio, Meta, delivered the environmental permit approved by the National Environmental Licensing Authority (ANLA) last week and promised support for the Llanos Refinery for Meta’s capital.