Another postponed decision and conflicting reports on the performance of Pacific Rubiales’ (TSX:PRE) secondary recovery technology Star have shrouded the project, which is the operator’s main bet for its namesake Rubiales field, in uncertainty.

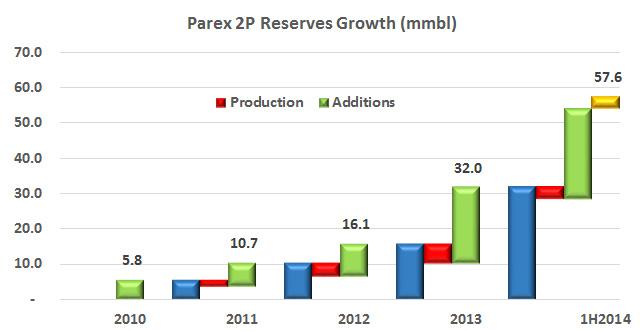

Parex (TSX:PXT) is establishing a summer-time tradition of updating its reserves every June. This year is no exception and this time, appropriately, the figures incorporate its acquisition of Verano Energy Ltd (‘Verano’ is the Spanish word for ‘summer’.)

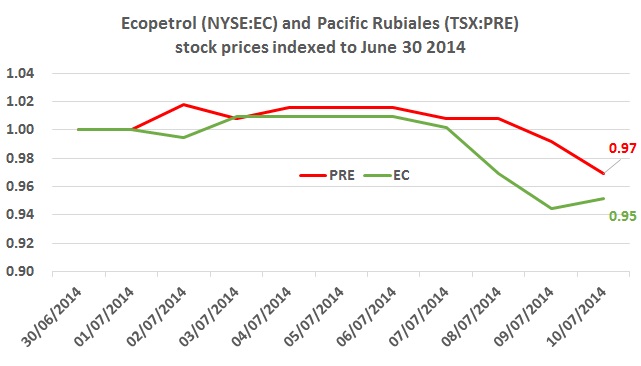

Ecopetrol (NYSE:EC) and four unions that fill its ranks have started the process to reach a new collective bargaining agreement. The last one was in place from 2009-2014 and Ecopetrol is optimistic that an agreement can be reached during direct talks.

After reaching an agreement that establishes the general terms of the negotiation for a new collective bargaining agreement, representatives from the USO and Ecopetrol (NYSE:EC) started talks in Bogotá on Monday, July 14.

Ecopetrol’s (NYSE:EC) board of directors has delayed a meeting to review a technical report on Pacific Rubiales (TSX:PRE) STAR secondary recovery technology to this week, and the Minister of Mines and Energy Amylkar Acosta has promised a decision this month.

The Minister of Mines and Energy Amylkar Acosta says that Pacific Rubiales (TSX:PRE) is not interested in an extension of the association contract for its flagship field Rubiales, offering instead to install its STAR secondary recovery technology.

The Empresa Energía de Bogotá (EEB) has bought a 7.78% stake in the Pacific Pipeline through subsidiary, Transportadora de Gas Internacional (TGI), after EEB paid US$880M to take its control of TGI from 68.05% to 99.97%.

Gran Tierra (NYSE:GTE) says its current COO Shane O’Leary will step down to retire, and will be replaced by Duncan Nightingale, the current president of Gran Tierra Colombia, with the Colombian senior operations manager Adrian Coral taking Nightingale’s position.

Ecopetrol (NYSE:EC) and Oxy (NYSE:OXY) have reached an agreement to apply an injection technology that they say will render 200 million additional barrels from the aging Teca-Corcorná field.

Ecopetrol (NYSE:EC) published a summary of advances made following an agreement with the U’WA community that allowed it to access the damaged Coveñas/Caño Limón pipeline in May. The NOC says it has kept up its part of the bargain but indigenous leaders still oppose exploration activities in the area.