Ecopetrol (NYSE:EC) was responsible for more than half of the research and development projects certified by state innovation and research agency Colciencias to obtain tax benefits in 2013.

Gran Tierra Energy (TSX:GTE) say its overall production fall by 8% sequentially and 9% yearly to reach 20,121boed in the second quarter of 2014, after a protracted sales cycle for a new customer and pipeline disruptions in Colombia accounted for a drop of 1,293boed.

Parex Resources (TSX:PXT) continues to grow its production organically and through acquisitions, and in the second quarter of 2014 posted an 8% increase sequentially and 29% increase year-over-year to reach 19,876bd.

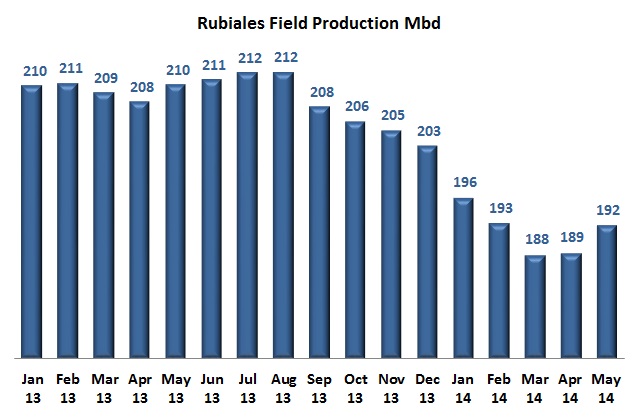

The National Environmental Licensing Authority (ANLA) has placed restrictions on the disposal of produced water from the Rubiales field into a waterway with the same name, citing the environmental risk for the area surrounding Pacific Rubiales (TSX:PRE) namesake, and largest producing field.

Ecopetrol (NYSE:ECP) released its second quarter 2014 financial results last week on Thursday evening (July 31) and blamed a complex security situation and community blockades for a drop in production. Meanwhile on its earnings call on Tuesday (August 5) market analysts questioned the company’s plans to boost production in its top fields.

There is progress to expand and modernize the Cartagena Refinery (Reficar), and the company says that nine of the 15 plants that must be ready to finish this long delayed project have now been completed.

Pacific Rubiales Energy (TSX:PRE) and the Minister of Mines and Energy Amylkar Acosta clarified that its STAR secondary recovery project has been suspended, but not cancelled altogether, and the post-pilot study will determine its future.

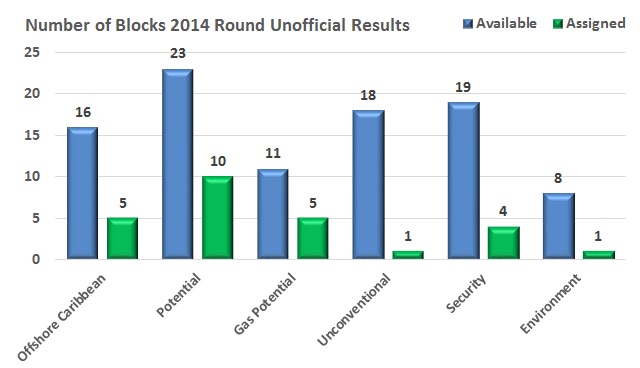

The 2014 Round of auctions is over and the Colombian government is all smiles (at least in public) with 26 of 95 blocks assigned. Unlike the previous round, all the onshore winners are companies already doing business in Colombia.

After a long awaited meeting of Ecopetrol’s (NYSE:EC) board of directors to discuss the use of Pacific Rubiales’s STAR secondary recovery technology, the companies issued a somber news release that says the pilot in Quifa will not continue. It would appear that the technology’s prospects are null for the Rubiales field, although neither are saying that yet.

The uncertainty surrounding the future of Colombia’s largest producing field, Rubiales, and the association contract between Ecopetrol (NYSE:EC) and Pacific Rubiales (TSX:PRE), has workers currently assigned in the UTEN union with the later firm demanding more clarity about their future.