Pacific Rubiales (TSX:PRE) CEO Ronald Pantin struck back at rumors that the Company was in danger of not fulfilling its financial obligations and that it is in good standing to continue operating even with a low price of oil.

The general manager of the Barrancabermeja Refinery shot back at critics saying that the project has not been frozen nor canceled, but still awaits definitions from the Ecopetrol (NYSE:EC) board of directors.

Gran Tierra Energy (TSX:GTE) again reduced its Capex Budget to US$140M from US$310M for 2015 due to the continued fall in the price of oil and the reevaluation downward of its reserves in Peru. The company’s CEO Dana Coffield’s employment has also been “terminated”.

The fall in the price of oil has moved the government to sound the alarms and start inspecting oil companies and contractors to verify their liquidity and ability to pay workers, suppliers and meet other obligations

A study conducted by the Colombian Petroleum Association and Burson Marsteller with 37 oil companies in Colombia found that more than half of them want to move investment to countries with lower tax rates like the USA, Brazil, Peru or Mexico.

The Minister of Labor Luis (Lucho) Garzon led a meeting on Wednesday with workers, company representatives and government officials to address to potential impact that labor cuts could have on the oil regions. This is a follow-on to an article we published yesterday.

State owned Turkish firm Turkish Petroleum International Company has received its environmental license from the National Environmental Licensing Agency (ANLA) to proceed with a project in Norte de Santander.

It is safe to say that Ecopetrol (NYSE:EC) is confronting one of its toughest years in 2015, with a complex scenario both internally, as it searches for a new president, and externally, as the fall of oil prices cuts into its exploration budget and future revenues.

The Colombian Petroleum Association (ACP) says that the impact on E&P activities due to the fall of oil prices will start to make a strong impact on daily crude production, which will likely start to decline in 2016.

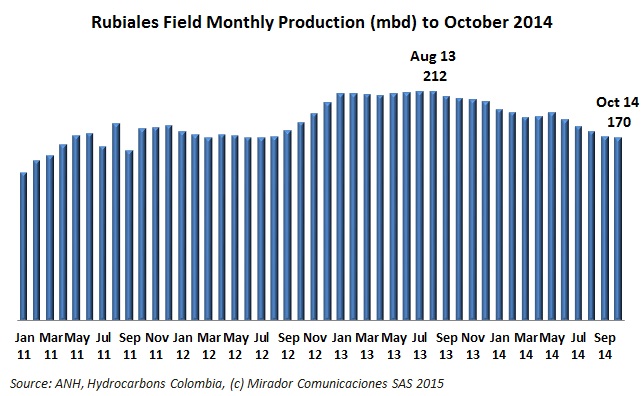

This article is not about Pacific Rubiales (TSX:PRE). It is about Colombia’s most productive field and the challenges of maintaining the 1mmbd goal.