Citing shifting, exaggerated demands and requirements from the local community near its Llanos 30 block E&P operations, Parex has decided to close the operation and cancel contracts with local suppliers.

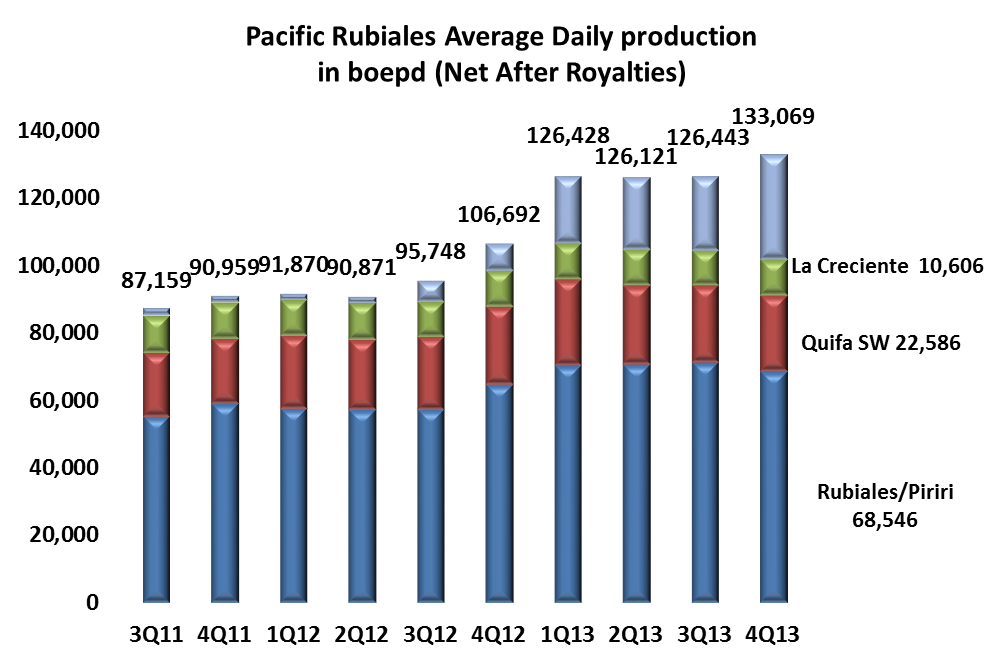

Pacific Rubiales Energy (TSX:PRE), says that it plans to leave its flagship field, Rubiales, as a success of the past, saying that it now represents only 11% of its proven reserves and that by the end of 2016 it will have been replaced. This process continues to define the company’s message to the market.

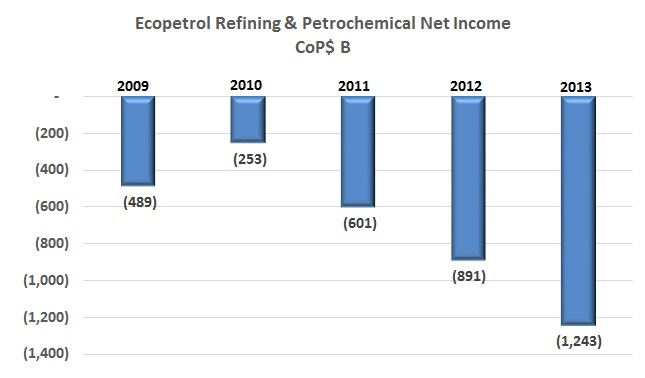

The growing demand for diesel and Colombia’s environmental requirements for the fuel, paired with a limited internal capacity of Ecopetrol (NYSE:EC) to produce this fuel could mean an increase of imports of the fuel by 7.4% in 2014.

Lately Ecopetrol has received much criticism for the slowness of refinery upgrades in Cartagena and Barrancabermeja. The harder question may be why it is investing at all in this business.

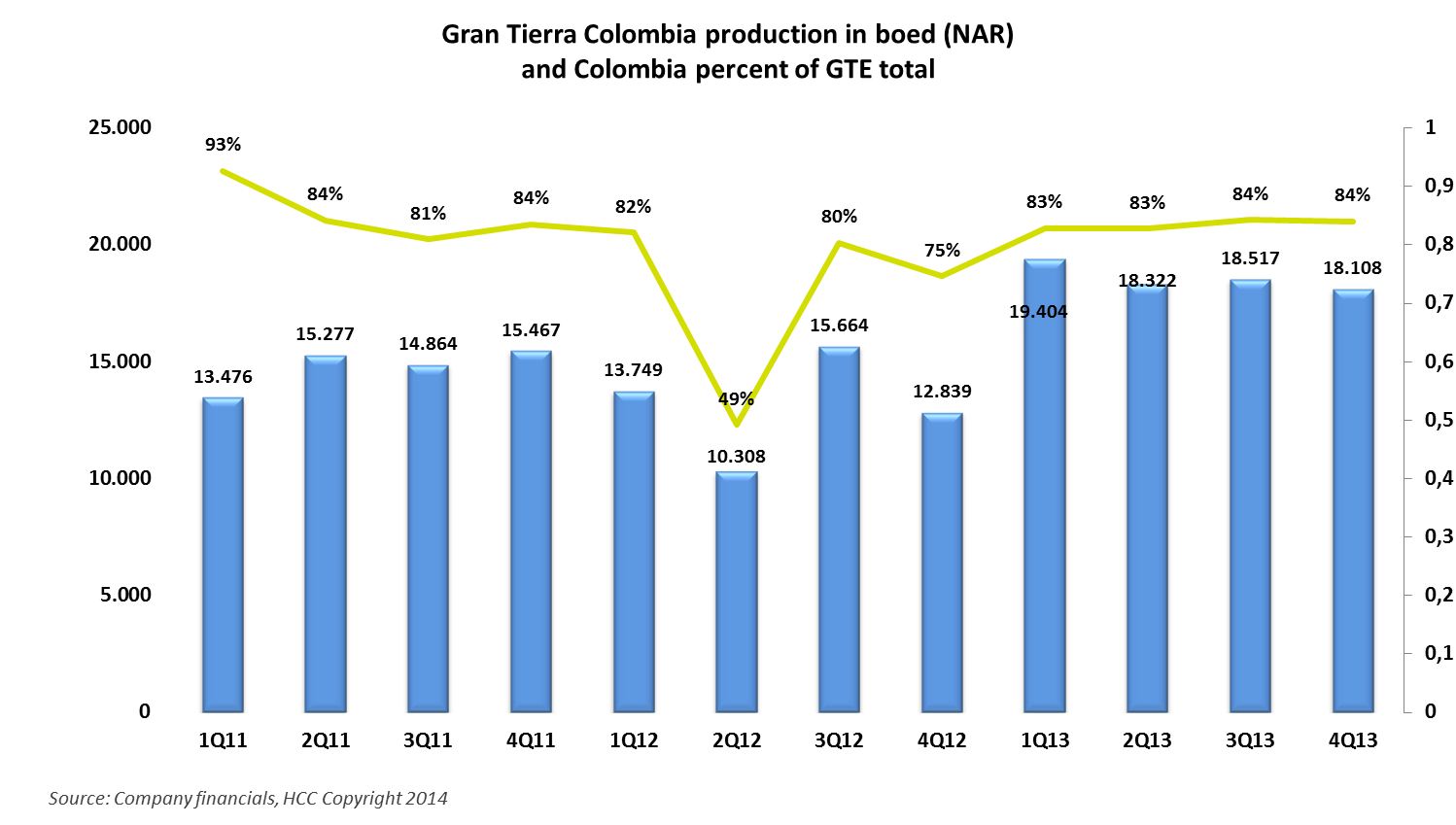

Gran Tierra Energy (NYSE:GTE) saw its Colombia production grow by 41.3% in 2013 to reach an average of 18,584boepd, which accounts for 83% of its total production.

Company officials held a call to discuss the end of year 2013 results and convince the market that its continued growth over the last five years is sustainable going forward despite operational complexities.

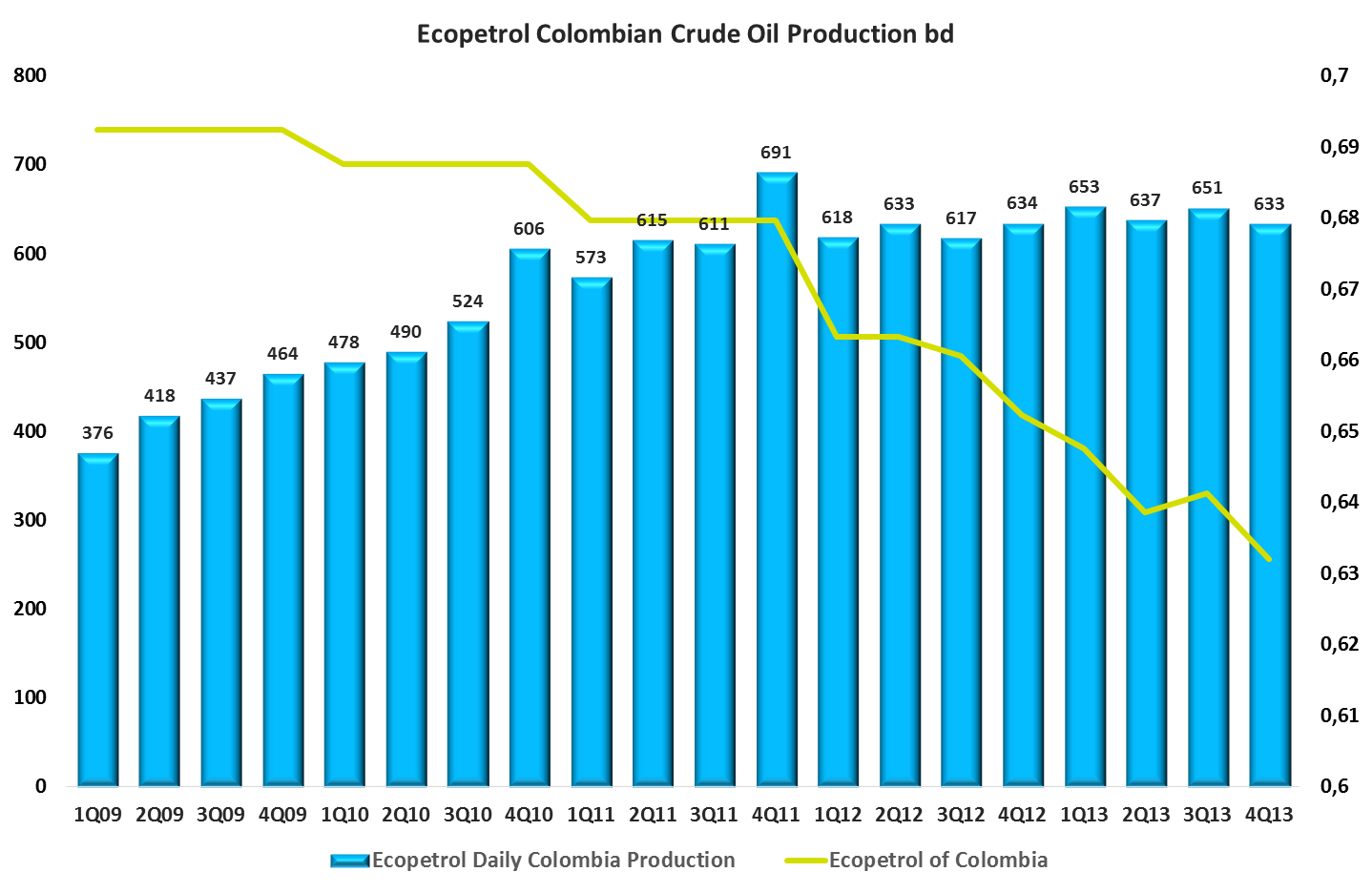

Ecopetrol (NYSE:EC) saw its production grow 4.5% in full year 2013 to reach 788.2mboed, a number which the NOC said suffered due to transport restrictions and blockades in some communities. The company’s net income fell in the same period by 10.8% to CoP$13.35T.

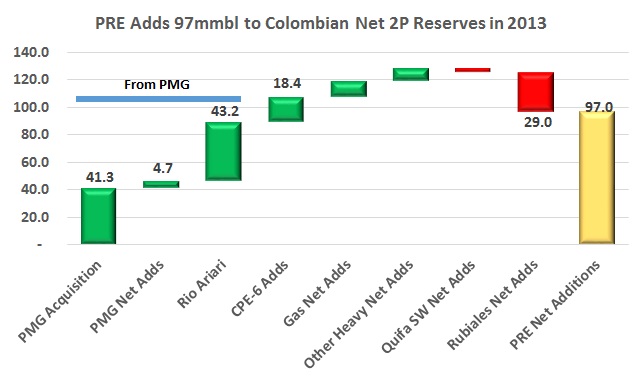

Pacific Rubiales reported its 2013 Colombian 2P reserves which increased 97mmboe or 22%. The graph shows the Petrominerales acquisition was critical to this, contributing 89 of the 97mmboe.

The continued conflicts in the municipality of Acacias and Castilla La Nueva have led to blockades, riots with police and now Ecopetrol (NYSE:EC) has terminated 45 contracts associated with projects in the area.

The Arbitration Tribunal of Bogotá’s Chamber of Commerce sided with Ecopetrol in a prolonged dispute over the formula used to figure payments received from Pacific Rubiales (TSX:PRE) in the Quifa field.