The corruption case involving former Ecopetrol (NYSE:EC) employees and a contract awarded to PetroTiger has arisen again after a new round of arrests, and the NOC says it is a victim and has been efficiently cooperating with the investigation.

Finally ruling on one of the more controversial and uncertain scenarios facing the Colombian oil industry, Ecoeptrol (NYSE:EC) has said it would not renew its association contract with Pacific Rubiales (TSX:PRE) for Colombia’s largest producing field, Rubiales.

The low price of oil is putting Colombia’s biofuels industry and future investments for it at risk says the National Federation of Biofuels (Fedebiocombustibles), although Ecopetrol’s (NYSE:EC) biofuel unit Bioenergy says it will move forward will an expansion of sugar cane crops for fuels and a long delayed plant.

Ecopetrol (NYSE:EC) says it has a contingency workforce and that a strike by the USO oil workers union would be illegal and could lead to dismissals. Meanwhile the union is preparing a 24 hours strike for March 19, which could be expanded into an indefinite one.

Parex Resources (TSX:PXT) posted strong production gains in 2014 through acquisitions and organic growth, hitting 22,526boed average for the year, a 42% increase over 2013. However struck by the fall in world oil prices, the company reported a net loss for the year of US$108.8M although more than 100% of this was due to a non-cash write down of assets in Colombia and Trinidad.

Pacific Rubiales (TSX:PRE) delivered a proposal which would keep it in the Rubiales field following the end of its association contract, offering a give and take to Ecopetrol (NYSE:EC) based on its ability to improve secondary recovery, expand the number of wells and implement new technologies.

Ecopetrol’s (NYSE:EC) board of directors voted in the government’s official candidate for the role of company president. Former Finance Minister Juan Carlos Echeverry takes the wheel of the NOC at one of its most complex moments.

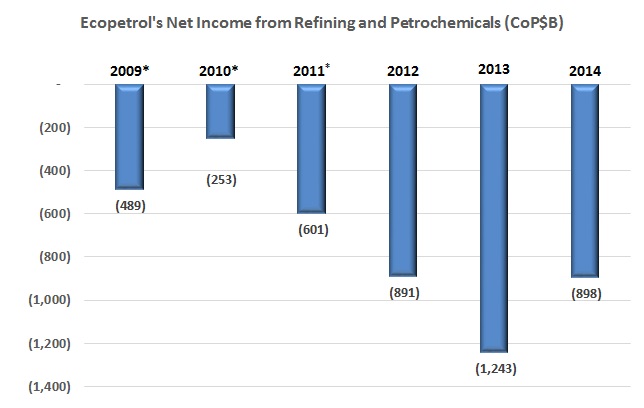

The graph shows Ecopetrol’s attributed Net Income to its Refining and Petrochemicals line of business for the full year 2014 and prior years. The good news is that things are not as bad as last year. The bad news is fairly obvious: it still lost nearly US$450M.

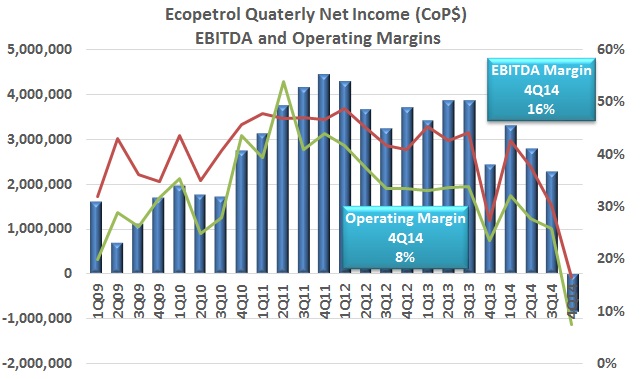

Ecopetrol posted a steep drop in profits in 2014 as the fall in the price of oil and a rise in costs took a hit on the company’s financial results.

The Minister of Mines and Energy Tomás González was on hand to herald the inauguration of Equion’s Floreña central processing facility (CPF), which he said is more important than ever considering the fall in oil prices.