The president of the USO oil workers union Edwin Castaño said that the “reinvention” of Ecopetrol (NYSE:EC) announced by the NOC’s new president Juan Carlos Echeverry is misguided and instead it should focus on directly operating all of its smaller fields.

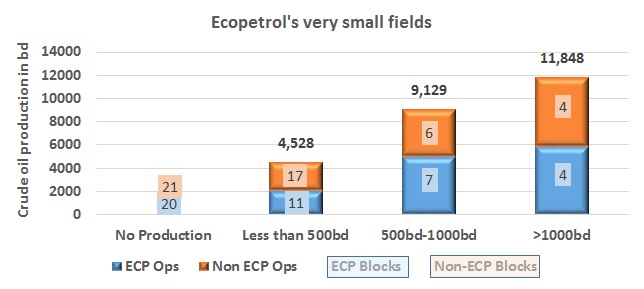

As part of its new strategy, Ecopetrol (NYSE:EC) is planning to focus on its larger producing blocks and implement a divestment plan for at least 45 of its smaller fields.

After statements made by USO president Edwin Castaño that Ecopetrol is considering sell part of its transport and logistics firm Cenit, Ecopetrol’s vice president Camilo Marulanda said that it is not an option being considered.

Ecopetrol (NYSE:EC) has released more concrete details on its strategy going forward, revealing plans to focus on its larger producing fields and divest of non-strategic assets.

The Santander Governor Richard Aguilar Villa said that he was able to confirm an official visit from Ecopetrol (NYSE:EC) president Juan Carlos Echeverry to discuss the future of the Barrancabermeja Refinery and address employment alternatives.

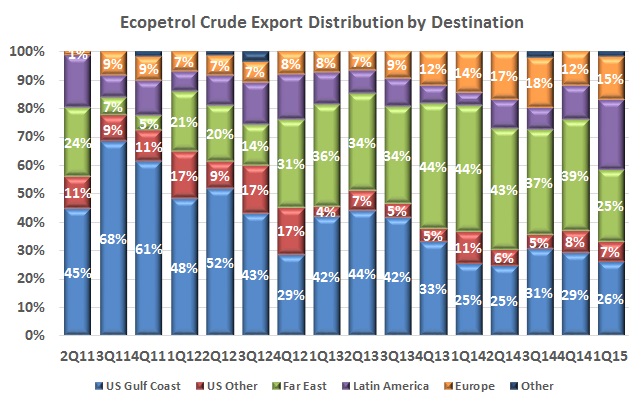

Ecopetrol (NYSE:EC) shifted its exports from Asia to Central America and the Caribbean. Could Venezuela’s need to end subsidies in Petrocaribe be the driver?

Ecopetrol’s (NYSE:EC) transport and logistics spin off Cenit saw an increase in its transported volume in 2014 despite standing out as one of the guerrilla’s favorite targets in the same year.

The president of oil & gas E&P firm Vetra Humberto Calderón Berti gave a rare press interview and said that the Llanos and Putumayo offer much in terms of prospectively, but the lack of infrastructure, high costs and public order issues represent the largest obstacles.

Despite a weakening of credit indicators for the oil industry and a combined debt of nearly CoP$7T, Colombia’s Central Bank has said that the financial sector is not at any risk due to the potential of unpaid obligations.

At the end of November 2014, reports surfaced that the Cartagena Refinery would be functional in January 2015 and see its commercial launch in August 2015. But in Ecopetrol’s (NYSE:EC) latest earning results, management said that once again, that timeframe will be pushed back.