Pacific Rubiales Energy (TSX:PRE) CEO Ronald Pantin says that the company is on solid financial standing and will be able to pay its long term debts and grow production, despite the collapse of the offer by investment groups Alfa and Harbour Energy.

The Minister of Mines and Energy Tomás González says that regardless of who owns Pacific Rubiales (TSX:PRE), the field must be operated properly and responsibly.

The expansion of the Sincelejo to Cartagena gas pipeline being planned by distributor Promigas has received its environmental license, allowing it to grow its capacity from 60mmcfpd to 165mmcfpd

Mexican investment group Alfa and Harbour Energy have terminated an agreement to purchase all of the remaining shares of Pacific Rubiales Energy (TSX:PRE), setting off a flurry of speculation and a deep dive in the share price of Colombia’s largest private oil operator.

A local paper dedicated a full feature article to explain the hope generated by the El Alcaraván sugar cane ethanol plant announced in 2010 by Ecopetrol’s (NYSE:EC) Bioenergy, and the impact its mismanagement left on the municipality of Puerto López, Meta.

Ecopetrol (NYSE:EC) has withdrawn its participation in a consortium formed to bid on offshore blocks in the Mexico Round 1 just days ahead of the presentation of bids.

Whether talking about the Cartagena Refinery (Reficar) or a planned ethanol plant of its affiliate Bioenergy, Ecopetrol (NYSE:EC) has shown a pattern of failing to keep its costs under control for large scale projects.

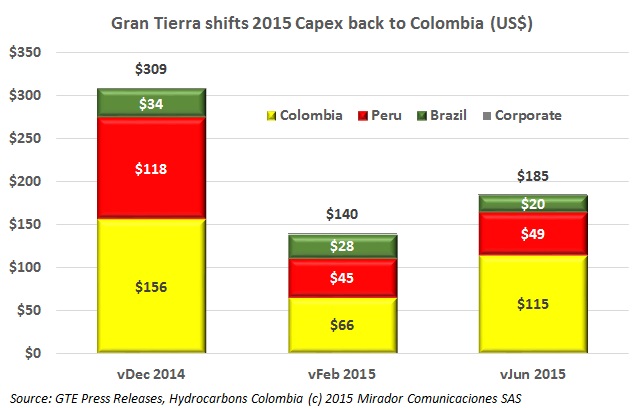

Gran Tierra Energy (TSX:GTE) said it has increased its 2015 Capex program by US$45M to US$185M for the year as part of a plan to accelerate development drilling in the Moqueta and Costayaco fields in the Putumayo Basin.

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry said that the recent wave of attacks on oil infrastructure will not have a substantial impact on the finances of its transport firm Cenit, and confirmed plans are still in place to relinquish control of its smaller fields.

In the last two weeks three executive managers at Ecopetrol (NYSE:EC) have retired as the company’s president Juan Carlos Echeverry adjusts his team.