Pacific E&P is advancing towards the close of its restructuring, and still holds a selection of E&P assets in Colombia, where its central focus will likely remain once the process is complete.

Celebrating 10 years in Colombia for the firm, Mansarovar Energy CEO Harvinderjit Singh said the company is here to stay, interested in competing for new areas and focusing its efforts on a streamlined and efficient operation.

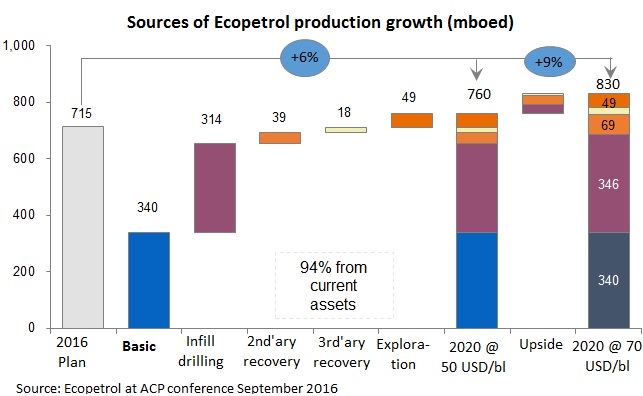

In an article last week on the new Ecopetrol (NYSE:EC) strategic plan for 2020, we remarked on the NOC’s pessimism. The same picture appears when looking at reserves.

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry is optimistic both on the future of the peace agreements and the Colombian economy. And he believes that reality will be kind to the NOC when it comes to growing its reserves.

As part of its restart of drilling in the Rubiales field Ecopetrol (NYSE:EC) is employing four cutting edge rigs to help streamline the operation and save both time and money.

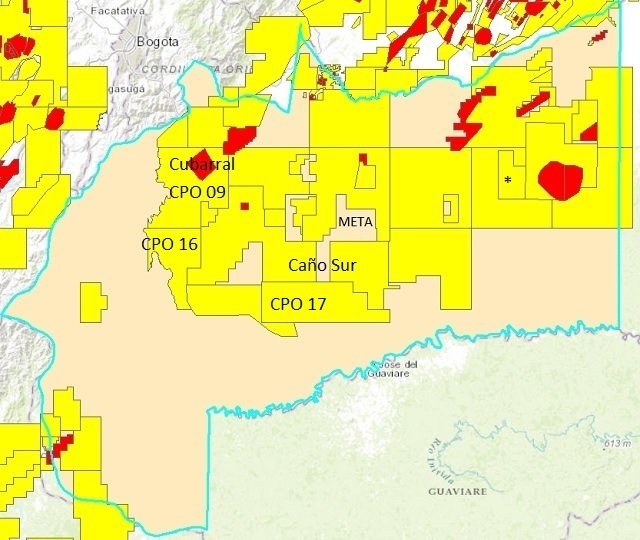

Six areas in the “Orinoco belt” — which occupies the foothills of the Llanos on the borders of Meta and Guaviare — look to extract up to 10M barrels over the next 10 years.

Ecopetrol (NYSE:EC) has launched its new business plan through 2020, with a renewed focus on exploration and production and an estimated US$13B investment plan.

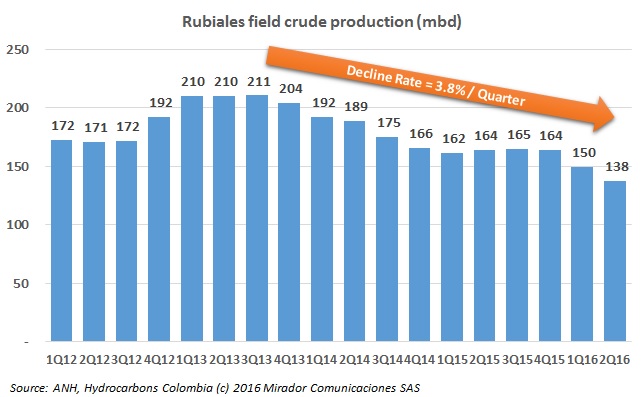

Ecopetrol (NYSE:EC) will start its Rubiales field drilling campaign this month with 72 wells planned for the country’s largest producing and recently reverted field.

Canacol Energy (TSX:CNE) said that it has revised its 2016 Capex plan and will increase its investments by US$34M to a total of US$92M and plans to drill three additional gas wells in the remainder of 2016.

Colombia’s most public (potential) unconventional project, still in its early exploration phase, has been suspended by ConocoPhillips (NYSE:COP) due to a series of blockades in the VMM3 block.