Ecopetrol (NYSE: EC) announced that it has found oil in the municipality of Rionegro (Santander). The company said that the well has a strategic position, suggesting more is to come.

The Corporate Reputation Business Monitor (Merco) and the Department for Social Prosperity (DPS) ranked the companies most-committed to social investment in Colombia. Pacific (TSX:PEN) was the industry’s leader on the list, at number 15.

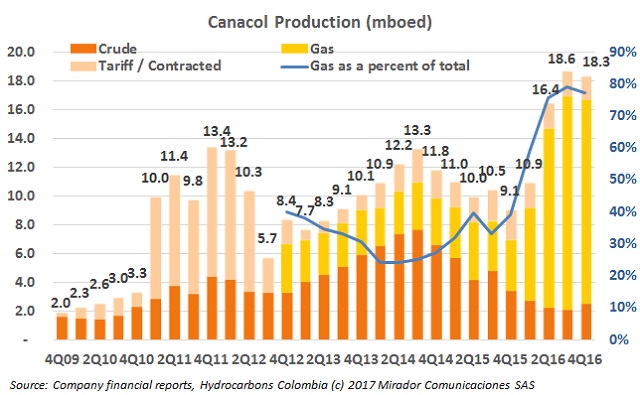

Canacol Energy Ltd. (TSX: CNE) announced its financial results for last year. The company achieved its production goal, made several new gas discoveries and reported an increase of gas sales. Company´s prospects for 2017 are optimistic.

In the past year, the gas sector invested CoP$1.2T to maintain the natural gas and electricity supply in the country.

Ecopetrol (NYSE: EC) wants to increase its gas production and the firm is looking for strategic alliances. The NOC will have a meeting with the Malaysian company Petroliam Nasional Bhd (Petronas).

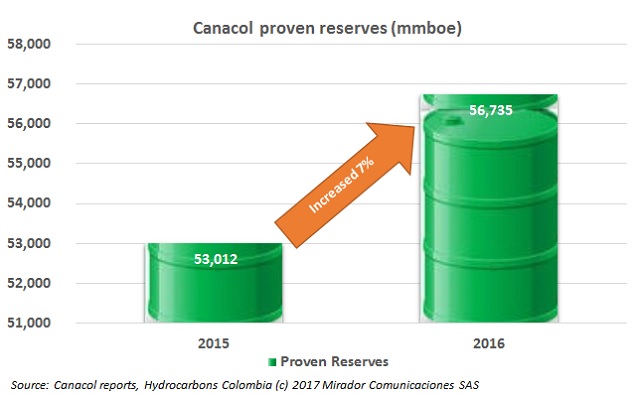

Canacol Energy Ltd. (TSX: CNE) reported its reserves volumes for 2016. The company is present in Lower Magdalena Valley, Llanos and Middle Magdalena basins in Colombia.

Amerisur Resources Plc (LON: AMER) announced asset acquisitions in the Caguan-Putumayo Basin. The blocks were bought from Pacific Energy E&P (TSX: PEN).

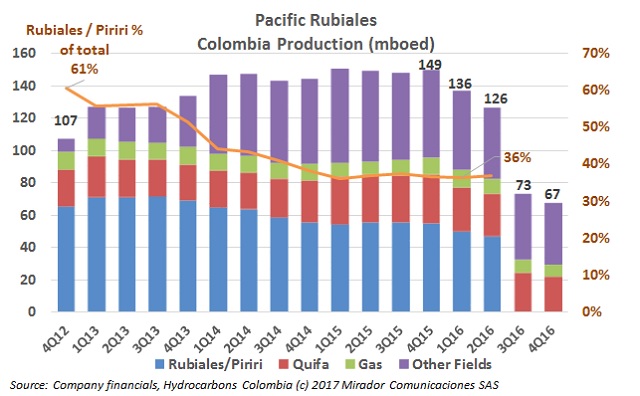

Pacific E&P (TSX: PEN) announced its financial statements for last year. The company reported a net production decrease and lower financial results, but the firm reported positive net income thanks to the restructuring.

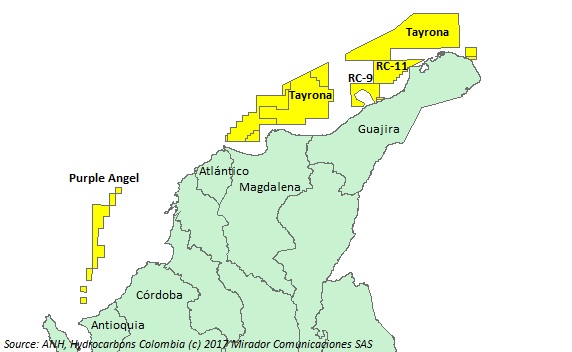

The government and authorities have been working to boost offshore exploration in Colombia and the sector is ready to start activities this year. The companies have their plans ready; only some regulations are missing.

Ecopetrol (NYSE:EC) and Pemex recently signed a document to study joint ventures in E&P, and now executives of both NOCs signed an agreement that allows the joint development of mature fields, enhanced recovery technologies and offshore exploration.