Ecopetrol (NYSE: EC) has focused on hydrocarbons exploration and production since it began operations, but decided to enter in a new line of business in Colombia.

Geopark (NYSE: GPRK) and Cepsa Colombia announced an agreement to work in a new high-potential exploration acreage in the country. This is the first alliance between the two companies.

Ecopetrol (NYSE: EC) enabled the connection of the Bicentenario, Araguaney and Central pipelines as a new route to extract oil from the Coveñas Caño Limon field (CCL) to Coveñas port.

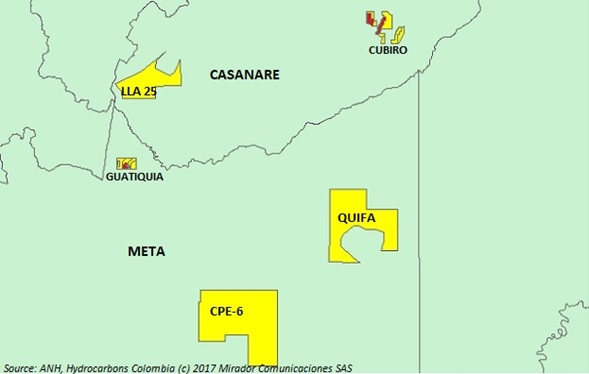

Frontera Energy (TSE: FEC) announced its plans for 2018 in Colombia. The company aims to strengthen its presence in the country.

Ecopetrol (NYSE: EC) and the Industrial University of Santander (UIS) are working on a molecular biology project to solve oil industry problems.

Offshore projects are progressing as planned and the sector has made announcements about these. Ecopetrol (NYSE: EC) made a decision on the drilling of the Molusco-1 well.

In recent years, Ecopetrol (NYSE: EC) has followed an austerity strategy to deal with the oil price crisis. The company committed to reactivate investment this year with heavy spending, but the firm is reducing its budget compared to initial plans.

Colombia’s Attorney General is investigating several officials of Hupecol Operating Co. for possible environmental damage.

The Colombian oil sector is facing many challenges and problems in the country. There is much concern about the industry’s future and several oil associations have joined forces to create a committee to boost the sector.

Canacol Energy Ltd. (TSX: CNE) announced that a test to develop its Picoplata 1 well through hydraulic stimulation was successfully completed.