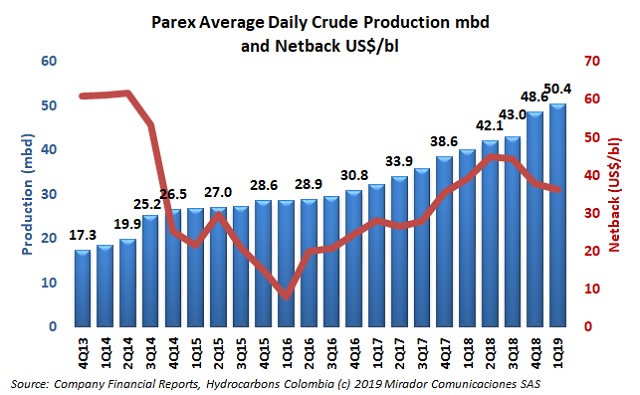

Parex Resources (TSX: PXT) provided an operational update and the company highlighted the results of the National Hydrocarbons Agency (ANH) bid round in June 2019. The firm won two blocks in this process.

Frontera Energy Corporation (TSX: FEC) announced its second quarter 2019 operational update. Colombia’s production decreased in 2Q19 compared to previous quarter, while the firm’s drilling campaign is advancing satisfactorily.

Geopark Limipted (NYSE: GPRK) announced the expansion of its portfolio on Colombia, after the National Hydrocarbons Agency (ANH) bid round in June 2019. The company won three blocks in alliance with Hocol (a 100% subsidiary of Ecopetrol (NYSE: EC).

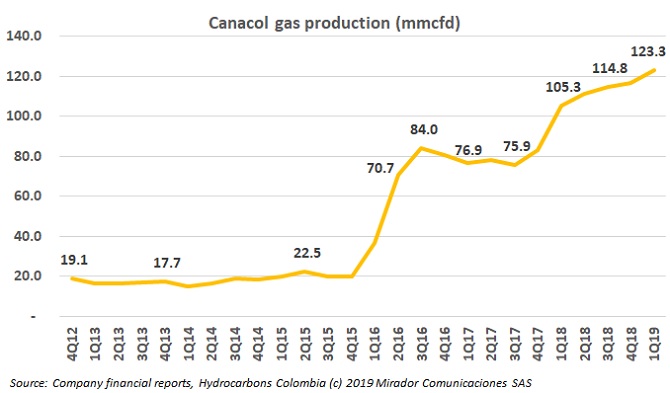

Canacol (TSX: CNE) participated in the South America Energy Series 2019 (SAES19) in Bogotá. Omar Serrano, Director of Strategy, Guilds and Contracts of CNE, spoke about the growth and expectations of the company in the country. HCC attended the event and we bring a brief summary of the meeting.

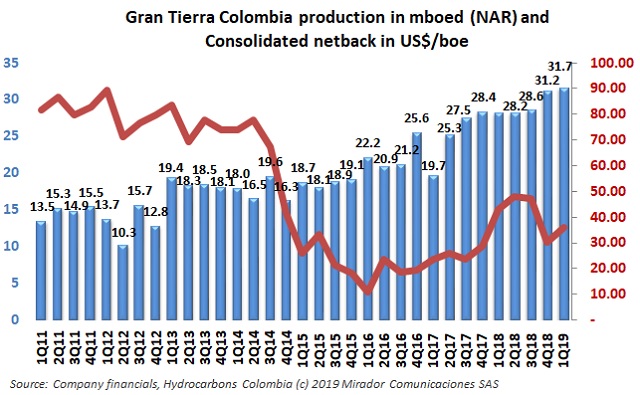

Gran Tierra Energy (TSX: GTE) announced an operational update for the second quarter of this year, to date. The company highlighted advances in the Acordionero field and positive results in Colombia’s most recent oil round.

Amerisur (LON: AMER) announced the signing of a conditional agreement with Occidental Andina, to dispose of a 50% interest in the Put-8 exploration area, in Putumayo.

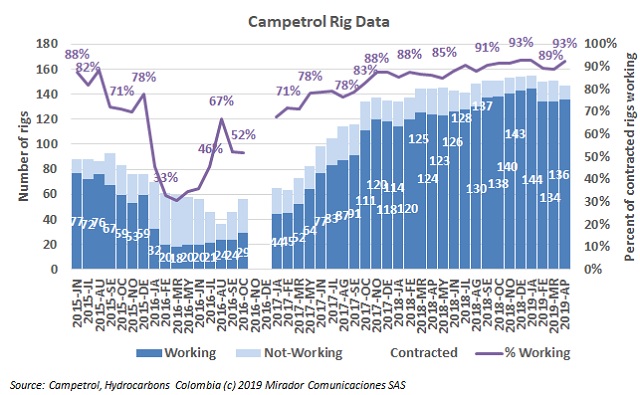

The Colombian Chamber of Goods and Services (Campetrol) talked about its forecasts for the rig count in 2019. The association showed its optimism for the behavior of the oil operations in the country for coming months.

Amerisur Resources (LSE: AMER) provided an operational update in Colombia. Here are the details.

Terpel has been working to diversify its product portfolio in recent months. Here is how.

Parex resources (TSX: PXT) provided an operational update, highlighting a discovery in the Une and Guadalupe formations.