After a brutal campaign that left many Colombians thinking about voting for ‘none-of-the-above’, President Juan Manuel Santos was reelected meaning we expect continuity in the current government’s policies.

The ICP (Colombian Petroleum Institute) has been around for 29 years and now is looking at both expanding its capabilities and decentralizing its operations.

The USO charges that the community’s rejection of a renewal of the association contract for the Rubiales field has prompted the arrival of some 700 paramilitary soldiers to intimidate local residents and the union ahead of a pending decision on the future of the field’s production.

Using Occidental (NYSE:OXY) as an example, an outspoken critic of the oil industry argues in a column that the government and controller must review association contracts renewed during President Uribe’s term because the formula to figure the state’s share is outdated, and apply the lessons to contracts up for renewal, such as Rubiales.

Colombia’s state training agency Sena has unveiled the installation of a specialized “industrial instrumentation room” in Huila, the fifth such facility in the country and part of a strategy to improve local talent in hydrocarbon matters.

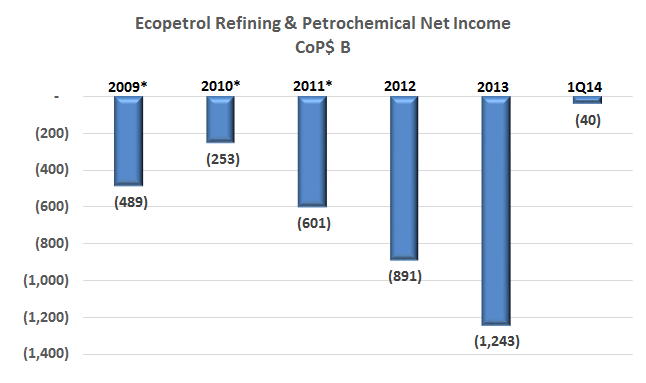

Long a drag on Ecopetrol’s margins, the NOC saw some improvements for its refining business as losses narrowed and the company increased the sales of products like asphalt and jet fuel. But questions still surround what has been the under-performer of the company’s operations.

After more than a year of discussions the government and ELN guerrilla group announced this week that the two parties have agreed to an initial agenda and structure for roundtable talks, expanding the scope of the government’s peace initiative just ahead of presidential elections.

A group of municipal and congressional authorities, along with members of the business community, journalists and even a bishop toured the Magdalena River multi-port facility which promises to use Colombia’s largest river as a new transportation option for hydrocarbons. It is set to be up and working in the middle of 2015.

A study by UK firm Arthur D. Little commissioned by the National Hydrocarbons Agency (ANH) gave Colombia a 3.9 out of 5 for its investment attractiveness to oil companies, ranking it behind Brazil and Mexico.

On May 17th the General Royalty System (SGR) officially marked its second anniversary, and a look at the results over the last two years shows highway projects have received the most funding, while regionally the Caribbean coast has benefited the most.