A volatile week for the peace talks after General Rubén Darío Alzate ended up in Farc hands, causing the government to suspend talks on Monday. An agreement appears to be in place that would liberate him and two other hostages, but many questions still remain.

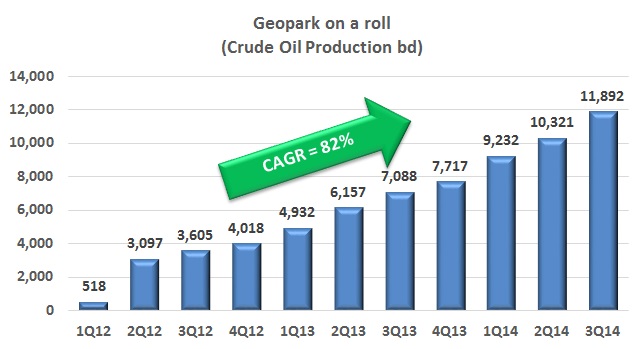

Latin American oil and gas producer Geopark (NYSE:GPRK) saw its overall production grow 66% year-over-year to reach 21,548bd in its overall production, with a 68% increase in Colombia to reach 11,934bd.

The president of the Colombian Petroleum Association (ACP) Francisco Lloreda Mera touched upon the falling price of oil, tax reforms and the outlook going forward, reinforcing the strategic position of the industry for government income.

Ecopetrol (NYSE:EC) gave a summary of its Corporate Social Responsibility (CSR) projects in Arauca and Casanare, while Amerisur participated in a program that converted families growing coca to pepper crops after 24 years of illicit farming. These and other stories in our regular round up of CSR related stories.

The National Association of Financial Institutions projects that once the modernization project of the Cartagena Refinery (Reficar) is finished, it could translate into 3.9% annual growth for oil refining between 2015-2020 and lead growth in the production of petrochemicals and plastics.

The government’s formula to fix gasoline prices aims for stability despite changes in the international price of oil, for better or worse. But some are questioning who is benefiting when oil prices have dropped over 20% in the last six months, but fuel prices less than 2%.

Now two years into the General Royalty System (SGR) the flaws and needed adjustments are clear, and the system must be tweaked to meet the intentions that it had during its conception says Senator Marítza Martínez

The Casanare Government Secretary Marlene Gutiérrez Oropeza said that the Interior Ministry has agreed to a “working road map” to deal with the controversial issue of Community Action Committees and their role in the hiring of local labor.

The Senate’s fifth commission held a debate on oil production, energy self-sufficiency and general oil policy, bringing in officials led by the Minister of Mines and Energy (MinMinas) Tomás González and Ecopetrol (NYSE:EC) president Javier Gutiérrez.

Ecopetrol (NYSE:EC) has inaugurated a new water treatment facilities in Acacías, Meta, which the NOC says will allow it to quickly increase production in the Castilla field by an additional 30,000bd.