The Colombian Chamber of Oil Goods and Services (Campetrol) executive president Rubén Dario Lizarralde has called for royalty funds which are not assigned to projects be returned to producing regions for development projects.

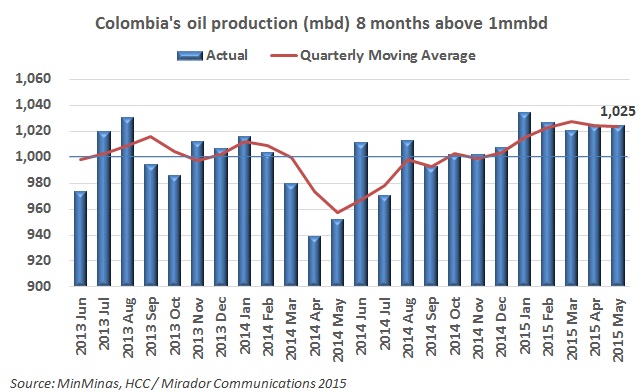

ProductionColombia continues its gravity (and naysayer) defying trick of maintaining production above 1 million barrels a day for yet another month. The mystery is how.

Ecopetrol (NYSE:EC) has offered more details on its new exploration strategy through 2030, which looks to reestablish its exploratory success and replace its shrinking supply of reserves.

Ecopetrol (NYSE: EC), is under fire for not following through on CSR commitments in Pompeya while Gran Tierra Energy (TSX:GTE) donates a pediatric wing to the Mocoa hospital. These and other stories on Corporate Social Responsibility (CSR) in our periodic summary.

High energy and transportation costs represent two of the major challenges for the hydrocarbons industry, and recent reports in a local business publication look deeper into the causes and future trajectory.

The Armed Forces stepped up their activities as the guerrilla maintained the pressure. Incidents were up by nearly one-third to 38 and guerrilla-initiated incidents were about equal to last week so the increase was due to their opponents.

In Meta a meeting between USO and Ecopetrol (NYSE: EC) executives brought a 15 day protest to a halt, while the union gears up for talks with Mansarovar Energy and supports a strike in Tibú.

The Minister of Mines and Energy Tomás González says that additional tax support is an alternative for the industry beyond already-approved measures, but industry observers question how these will work out in practice.

Ecopetrol (NYSE:EC) has concluded an inspection of submarine pipelines in the Coveñas port, which will connect exportable crude from the land terminal to loading boats at sea.

The president of the USO oil workers union Edwin Castaño said that the “reinvention” of Ecopetrol (NYSE:EC) announced by the NOC’s new president Juan Carlos Echeverry is misguided and instead it should focus on directly operating all of its smaller fields.