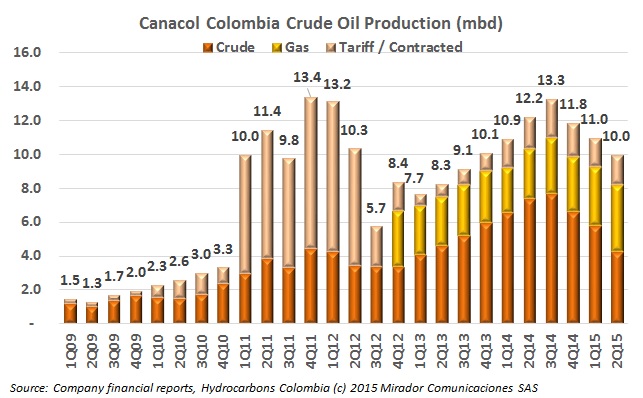

Canacol Energy (TSX:CNE) continues its transition to focus on gas production which outpaced crude production in the 2015 fiscal year, and in the quarter ending June 30 went up at the nearly same rate crude production went down. But its bottom line was hit by the fall in oil prices, resulting in a loss.

President Juan Manuel Santos arrived in Cuba to reach a preliminary agreement with the Farc commander Timoleón Jiménez, alias ‘Timochenko’, in which both have promised to sign the final agreement and end the more than 50 year conflict in the next six months.

The president of the National Hydrocarbons Agency (ANH) Mauricio de la Mora now says that the entity is planning a ‘mini-round’ where it will offer three blocks in December of this year, an abrupt shift from recent comments he made on how the entity will promote investment.

The Ministry of Mines and Energy is preparing a decree which it says is necessary to stimulate the construction of gas pipelines through direct state intervention and tenders. But private industry says the problem is in the regulations.

With the fall in oil prices specialized workers like oil engineers and general employees originally attracted to better salaries in the oil industry have suffered, creating added tension towards foreign workers and there is no clear alternative in sight.

Ecopetrol (NYSE:EC) president Juan Carlos Echeverry says the NOC is learning to reverse a trend of “thinking fast and acting slow”, and that its main strategy to improve its results in the short term is in improving the recovery factor. Exploration is for production of the future.

The National Hydrocarbons Agency (ANH) president Mauricio de la Mora said that the agency is preparing another series of measures that will help improve the conditions for the industry to remain competitive, with a focus on how it will assign new blocks.

Industry and community representatives complain about how poor road quality in Caquetá affects business, meanwhile a special hearing will be held to decide if Pacific E&P (TSX:PRE) is responsible for damage on the Corocoro-Cravo Norte highway. These and other stories in our periodic roundup of road-related issues.

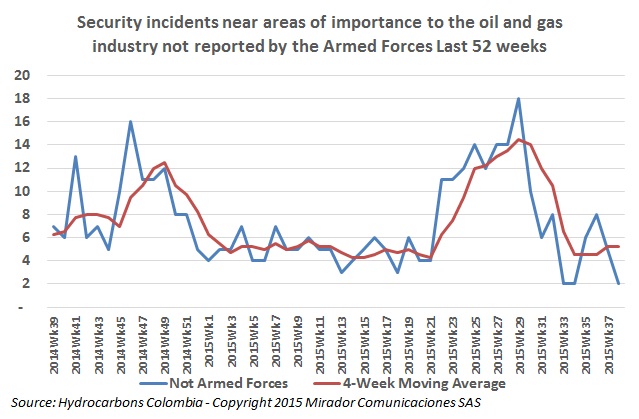

Ecopetrol (NYSE:EC) published a look a back on the 2,572 attacks on its oil infrastructure between 1986 and 2015 by the guerrilla, and gave a small glimpse into some of its impact.

A study from an energy consultancy found that the Colombian thermoelectric sector only has 34% of the natural gas it needs to purchase to produce the country’s energy during the El Niño weather phenomenon.