Editor’s Note: David Yanovich is a Colombian consultant and investment banker who has been part of the Hydrocarbons Colombia community since the very beginning.

Last week we asserted that Naturgas president Eduardo Pizano was incorrect when he said that there was enough gas to meet demand and that El Niño had only caused the “feeling of shortages”.

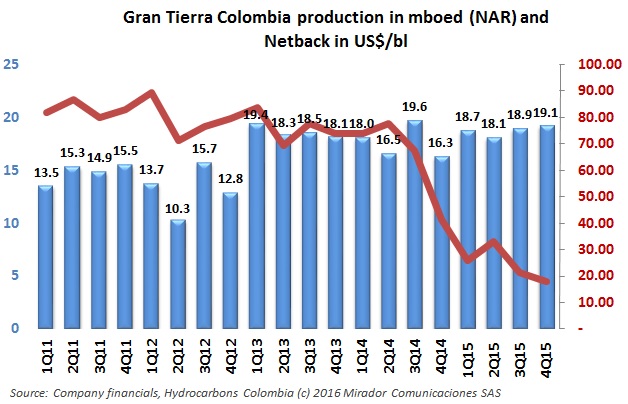

Gran Tierra Energy (TSX:GTE) says 2015 was a “transformational” year and it is in good financial shape to be competitive going forward. It posted a loss for the year of US$268M, but shrunk its loss in the fourth quarter by over 70% compared to the previous year.

Confounded by the cuts in investment and exploration due to the fall in crude prices, Colombian services firms are looking outside of the hydrocarbons industry to find new clients.

USO delegates met with management from Cenit, the transportation spin-off of Ecopetrol (NYSE:EC) and warned that a plan to fold remaining transport assets into Cenit will make way for Cenit’s sale.

GasThe president of the Association of Natural Gas (Naturgas) insisted that the supply of natural gas is just fine, and that the “feeling” of scarcity is just due to El Niño.

A 2015 perceptions survey carried out by the Chamber of Oil Goods and Services (Campetrol) showed that almost no service companies could call 2015 a good year, and the association called for immediate action from the government to restart Ecopetrol’s (NYSE:EC) exploration program.

Pacific E&P (TSX:PRE) was the affected operator in another Constitutional Court decision regarding the prior consultation process and an indigenous group in Puerto Gaitán, Meta, which affects the operator’s operations in Quifa.

Images of Farc negotiators in public, accompanied by armed guerrillas in a public plaza in La Guajira for a peace campaign, led to condemnation by the government and a halt in talks. With the urging of the guarantor nations, the impasse was resolved, but the incident demonstrates how fragile the process is at this point.

The Central Bank released Foreign Direct Investment (FDI) figures for January 2016, and the fall was nearly 60% compared to the same period last year, affected by more than just energy and mining.