The Constitutional Court Decision on projects and the prior consultation process in Orito Putumayo and Puerto Gaitán, Meta have put the legal certainty of extractive projects in limbo, and more decisions are expected.

The National Hydrocarbons Agency (ANH) board of directors has approved regulatory changes to how it will assign blocks, and reports suggest it has taken into consideration at least some of the observations from the Colombian Petroleum Association (ACP).

Drawing parallels to the Cartagena Refinery, the USO has turned its attention to the delays and problems that have plagued the construction of an ethanol plant by Ecopetrol (NYSE:EC) subsidiary Bioenergy.

Ecopetrol (NYSE:EC) had been able to escape quarterly losses for much of 2015, buoyed by its transportation business and improved refining results. But its year end 2015 financial results could not escape a global trend of impairment charges from the low oil price, with the NOC posting a CoP$3.9T loss (US$1.23B)

Ecopetrol says that it has tapped Fernán Ignacio Bejarano Arias, who has worked with a number of public entities and boards, as its new legal vice president.

It will not be official until May 2016 but with Ecopetrol’s reserves announcement this week, it seems to us that Colombian oil reserves will drop over 10% to something under 2,100 mmbl.

Discussions between OPEC and Russia on reducing production have borne some fruit. The graph shows weekly closing prices for Brent and WTI during the past year.

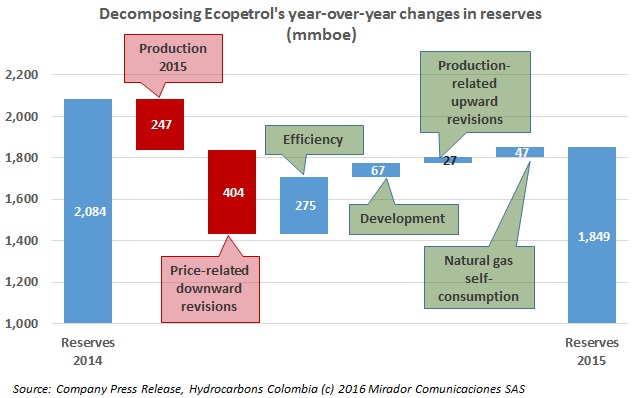

Ecopetrol (NYSE:EC) announced an 11% reduction in its 1P reserves of crude and natural gas in 2015, confirming a reserves/production ratio of 7.4 years.

Ecopetrol (NYSE:EC) has received permission from the National Hydrocarbons Agency (ANH) to suspend the Akacías field in the CPO-9 block in Meta, the second such shut in it has announced in as many weeks.

Julian Garcia Salcedo has been designated as the new president of TGI, the natural gas distributor owned by The Bogotá Energy Company (EEB) with one of the largest urban gas networks in the country.