Even one of Colombia’s main business publications has questioned statements from the Minister of Mines and Energy Germán Arce, who argued that the technique should be applied in Colombia. What can be expected from the popular press?

Colombia’s Superintendente de Sociedades (SuperSociedades) compiled a comparison of the income, profits and assets of the country’s largest 1000 companies, and the mining/hydrocarbons sector registered one of the biggest drops over the last year.

May finished with a call by the ELN for a bilateral ceasefire, something that has not been achieved with the Farc even after years of negotiations. The government has not reacted but we doubt there would be much public support.

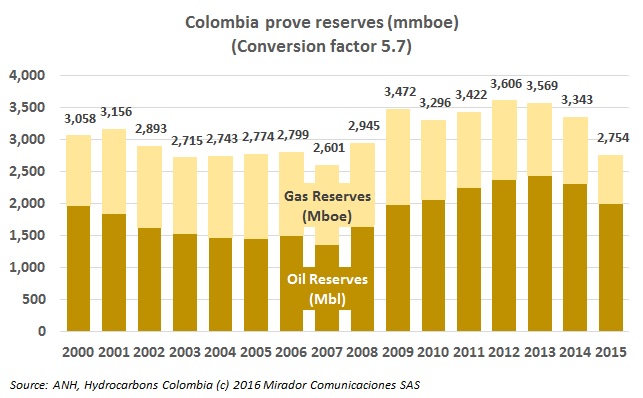

Last week, MinMinas finally published 2015 reserve data. Accentuating the positive, the press release talked mostly about probable and possible reserves, dismissing the decline in proven reserves as a temporary statistical phenomenon.

Editor’s Note: Warren Levy has been around Colombia and around the oil and gas industry for a long time. With an extensive history in the services industry, he has direct knowledge of the impact it can have on the countryside.

The Constitutional Court issued a ruling that eliminated a law which prohibited territorial authorities from prohibiting mining projects in their areas, but the Minister of Mines and Energy German Arce insists that it does not mean that extractive projects could be affected.

Led by the Barrancabermeja Mayor’s office and Senator Jorge Robledo, the municipality held a its second “Forum for the Defense of Water and Ecosystems” and charged that fracking is the new threat against Middle Magdalena’s water supply.

The USO has joined a group of unions, NGOs and Senators to create the National Committee for the Defense of Public Assets, and said that the first task would be to take legal action against the president of municipal utility ETB, Jorge Castellanos.

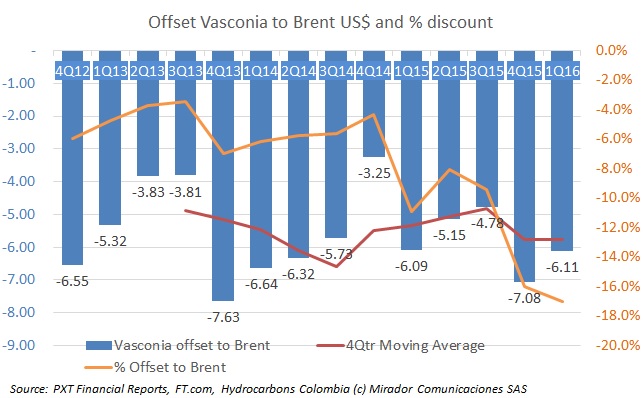

As oil prices have slid, we have been asked about trends in offsets to various oil price benchmarks. We found quarterly Vasconia figures (thanks to Parex) and so were able to check the offset between Colombia’s most important benchmark and what is today the most important global benchmark, Brent. The gap or offset between WTI and Brent has shrunk as prices decreased, what happened to Vasconia and Brent?

A dispute with a corporation of community action committees (JACs) in Acacías has led to blockades, threats against workers and even fuel filled bottles being thrown at Ecopetrol’s (NYSE:EC) drilling equipment which is destined for the Chichimene field.