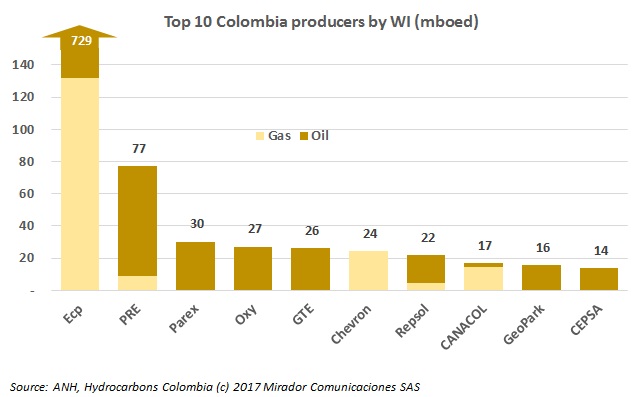

We normally look at “Top 10 Oil producers” and “Top 10 gas producers” separately so this time we thought we would combine the list.

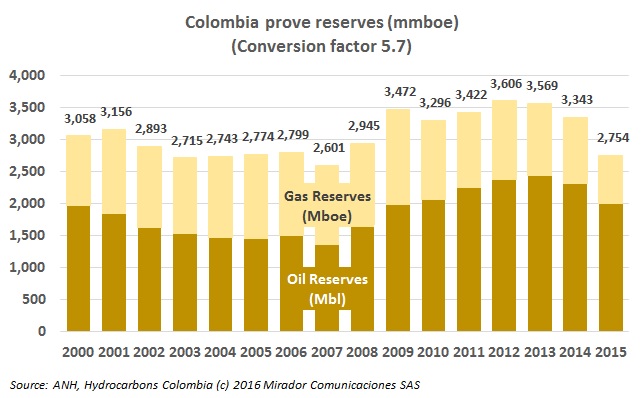

Colombia is not an oil-country but has the potential to be self-sustaining in the medium and long term, according to a study of the Geo Sciences Department of the National University. Carlos Alberto Vargas Jiménez led this research.

President Juan Manuel Santos said the High Councilor for the Regions, Carlos Correa, proposed making the General System of Royalties (SGR) more flexible and with this, allow infrastructure projects that are being developed in the regions be done with more agility.

The Colombian Chamber of Petroleum Goods and Services (Campetrol) organized a workshop to talk about tax reform. HCC was present at the event; we have a brief summary of the meeting.

This week, USO celebrated the fact that Cartagena’s Court decided to stop a legal process against one of its leaders, as well as the sanction that was levied on Ecopetrol (NYSE: EC) for allegedly imposing a ’voluntary agreement’ on its workers. However, events such as the protests in Nuevo Córdoba and the arrest orders against leaders from 2016’s tanker strikes remain a cause for concern to the Union leaders.

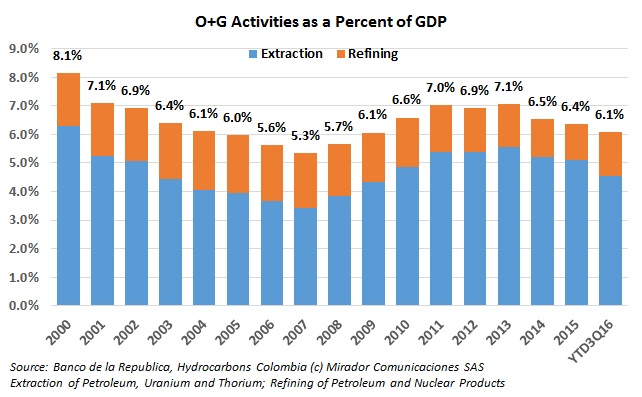

This week we published a story and two tweets about whether Colombia did or did not use the windfall from high oil prices correctly. The ‘votes’ were 2-to-1 in favor of a wasted or lost opportunity.

A companion article by our Managing Editor deals with the question “Is Colombia too dependent on oil and gas?” It also addresses MinHacienda Mauricio Cárdenas’ contention that the industry is, in his words, ‘irrelevant’.

President Juan Manuel Santos asked MinHacienda Mauricio Cárdenas and MinMinas Germán Arce, to meet with Colombia’s mayors and governors to resolve the ‘controversy’ that changes to the gasoline surcharge has aroused.

Many opinions have come out after the decision of the Ministry of Mines and Energy (MinMinas) to reduce the gas surcharge. German Arce, MinMinas, explained his rational.

High oil prices helped many countries to diversify and grow their economies. The Peterson Institute conducted an analysis of 40 nations to see if they took advantage of oil boom. Colombia was part of this research.